Latest News

-

Modi aims to trade $20 billion in five years with India and Brazil as they sign a mining pact

India has deepened its trade ties with Brazil, signing a pact on Saturday to increase cooperation in mining and minerals. The country is seeking to meet the rising demand for steel at home and to support capacity expansion as a result of a global race to secure raw materials. The agreement was signed by India's PM Narendra Modi, and Brazilian President Luiz inacio Lula Da Silva. Both men arrived in New Delhi this week on a three-day trip. Brazil has large reserves of minerals that are critical for steelmaking. It is one of the top producers of iron ore in the world. India will benefit from closer cooperation by gaining access to the raw materials and technologies it needs to maintain its long-term steel growth, according to a statement released by the Indian government. INVESTMENT IN INFRASTRUCTURE According to the statement, the cooperation will be focused on attracting investments in exploration, mining, and infrastructure for the steel sector. India has a steelmaking capacity in excess of 218 millions metric tons. Companies are increasing output to meet the rising demand for domestic steel, driven by industrialisation and infrastructure development. Modi, who met with a Brazilian delegation led by Lula to discuss ways of deepening the India-Brazil trading partnership, said that their discussions had been centered on how to do so. Modi stated that he was committed to doubling bilateral trade in the next five-years. The bilateral trade between the two nations is currently at around $15 billion. Modi said that "our nations will also be working closely in a number of areas, such as technology and innovation, digital infrastructure, AI, semiconductors, and more." LATIN AMERICA'S LARGEST TRADING Partner India and Brazil are strategic partners and have been since 2006. Their cooperation spans trade, defence and energy, agriculture and health, as well as critical minerals, technology and digital infrastructure. Brazil is India's biggest trading partner in?Latin America & Caribbean, and both countries are closely involved with global issues like U.N. Reform, climate change, and counter-terrorism. Lula said on Thursday that Brazil and India should conduct their trade in their own currencies, rather than settle transactions in U.S. dollar, but denied speculations about the BRICS, a group of countries which includes both nations, creating a common currency.

-

Trump pivots on new 10% global tariff and new probes following Supreme Court setback

U.S. president Donald Trump moved quickly on Friday to replace tariffs that were struck down by the Supreme Court, with a temporary 10% worldwide import duty for 150-days and ordered new investigation under other laws which could allow him reimpose the tariffs. Trump signed an executive order late Friday night to begin imposing new tariffs on Tuesday under Section 122 of Trade Act of 1974. This will replace tariffs of up to 50% that were imposed by the 1977 International Emergency Economic Powers Act, which the Supreme Court declared to be illegal. It also ends the collection of these now-banned tariffs. The orders continue exemptions that were already in place, including for aeronautical products; passenger cars; some light trucks; goods imported from Mexico and Canada which are compliant with U.S. Mexico-Canada Trade Agreement; pharmaceuticals; and certain critical minerals; and agricultural products. Scott Bessent said that the new 10% duties, and possibly enhanced tariffs, under Section 301 of the unfair practices statute, and Section 232 of the national security statute, would result in almost unchanged tariff revenues in 2026. "We will return to the same level of tariffs for the countries." Bessent, a Fox News reporter, said that it will be less direct and a little more convoluted. The Supreme Court's decision has reduced Trump's bargaining power with trading partners. Section 122, which has never been used before, allows the president to impose up to 15% in duties for up to 150-days on all countries in order to deal with "large and significant" balance of payment issues. This authority does not require any investigations or other procedural limitations. After 150 days the Congress would have to approve their extension. Trump said, "We have great alternatives." "Could mean more money." Trump said that the alternative tools would allow us to take in more revenue and make us stronger. The 10% tariff order justified the use of Section 122, noting the U.S.'s "large and serious balance-of-payments deficit" and that the situation was worsening. The Section 122 Tariffs will expire before a final decision can be made. This is according to Josh Lipsky, International Economics Chair at the Atlantic Council in Washington. Trump also said that his administration was initiating a number of new?country specific investigations under Section 301 of 1974's Trade Act "to protect our nation from unfair trading practices of foreign countries and companies." The executive order instructed the U.S. Trade Representative to investigate "certain unfair and discriminatory policies, practices and acts that burden or restrict U.S. Commerce," but it did not specify any specific 'targets. USTR has opened investigations on China, Brazil and other major trading partners such as Vietnam and Canada. FASTER INVESTIGATIONS Trump's move to other statutes including Section 122 while initiating new investigation under Section 301 was widely anticipated. However, these investigations have taken an average of a year. Trump has said that the 10% tariffs will only last for five months. When asked if the rates would end up higher in the future after more investigations, Trump replied: "Potentially." It depends. "Whatever we want them to become." He said that some countries, which "have treated us badly for many years", could face higher tariffs. For others, "it will be very reasonable" for them. In the wake of this ruling, the fate of dozens trade agreements to reduce IEEPA-based tariffs and negotiations with U.S. major trading partners remained uncertain. Trump did say that he expected most of these deals to be continued. He said that he expected many of the deals to continue. Tim Brightbill of the Washington law firm Wiley Rein said that this is unlikely to have an impact on reciprocal trade agreements with our trading partners. "Most countries prefer the certainty of a deal over the chaos last year." U.S. trade representative Jamieson Greer stated that details about new Section 301 investigation would be revealed within the next few days. She added that these investigations are "incredibly durable legally." Trump used Section 301 during his first term to impose tariffs on Chinese imports. REFUNDS TO Be 'Litigated' Penn-Wharton Budget Model's economists estimate that the Supreme Court's ruling could result in a refund of up to $175 billion collected as tariffs over the last?year. When asked if he'd refund the IEEPA duty, Trump replied that the matter was likely to be litigated between two and five years. This suggests that a fast, automatic refund is unlikely. Bessent, speaking in Dallas to business leaders, said that the Supreme Court had not provided any instructions regarding refunds. He added that those were "in dispute" and that it could take weeks, months or even years. MORE PROCEDURES Trump chose IEEPA last year to impose tariffs in part because of the 1977'sanctions statute', which allowed for fast and wide action with little or no restrictions. He had used it to punish countries for non-trade disputes such as Brazil's prosecution against former president Jair Bolsonaro, who was a Trump ally. Janet Whittaker of Clifford Chance, Washington, says that while Trump's investigations may prolong tariff uncertainty, it could also bring more order to his tariff policy by forcing him rely on laws with well-understood processes, requirements for public comments and research, as well as longer deadlines. Whittaker stated that "the administration will need to follow these processes and conduct investigations. This means for businesses more visibility in the process." Robert Lighthizer was Trump's first-term trade chief. He said that he wanted Congress to revise old trade laws so Trump could have new tariff tools. Lighthizer stated, "I hope they will use this opportunity to change the system." Reporting by Gram Slattery in Washington; additional reporting by Doina chiacu. Writing by David Lawder. Editing by Deepa Babington. David Gregorio, Diane Craft, and Deepa Babington.

-

The top cases in the US Supreme Court docket

During its current term, the U.S. Supreme Court will decide a number of important cases involving such issues as presidential powers and tariffs, gun rights, birthright citizenship laws, transgender sports, campaign finance laws, voting rights, LGBT “conversion therapy”, religious rights and capital penalty. The term began in October, and will run through June. Separately, the court has also acted in emergency cases in several cases that challenge President Donald Trump's policy. TRUMP'S TARIFS The Supreme Court ruled on February 20, a decision that has major implications for global economics, to?down' Trump's tariffs. Trump had imposed them under a law intended for national emergencies. The ruling, which was 6-3 in favor of the lower court decision, confirmed that Trump had exceeded his legal authority by using this 1977 law. The court ruled that Trump did not have the authority to impose tariffs based on the law in question, the International Emergency Economic 'Powers Act (IEEPA). Congress has the power to impose taxes and tariffs, not the President, according to the U.S. Constitution. Tariffs are at the heart of a global trade conflict that Trump started after he entered his second term in office. This war has alienated trading partner, affected financial markets, and created global economic uncertainty. TRUMP'S FIRE OF FED OFFICIAL Justices showed skepticism towards Trump's attempt to fire Federal Reserve Governor Lisa Cook, in a case which could threaten the independence of the central bank. The justices said they would not grant Trump's request for a judge to overturn a decision that prevented him from firing Cook immediately while her legal case played out. Congress created the Fed by passing a law called the Federal Reserve Act. The law included provisions meant to protect the central bank against political interference. Governors could only be removed from office by the president "for cause", though it does not define that term or establish procedures for removal. Trump claimed that Cook's firing was due to unproven allegations of mortgage fraud, which she has denied. Cook, who is still in her position for now, said that the allegations were a pretext used to fire Cook over differences of monetary policy, as Trump pressures the Fed to reduce interest rates. The ruling is expected to be made by the end June. Birthright Citizenship The court will hear arguments about the legality of Trump’s directive on April 1, which restricts birthright citizenship. This is a controversial part of Trump’s efforts to curb immigration, and would change the way a 19th-century constitutional provision has been understood for many years. The lower court blocked Trump’s executive order, which instructed U.S. agencies to refuse to recognize citizenship for children born in the U.S. when neither parent was an American citizen or a legal permanent resident (also known as a "green-card" holder). The court found that Trump's directive violated both the 14th Amendment of the U.S. Constitution and federal law codifying the birthright citizenship rights. LOUISIANA ELECTORAL DISTRICTS The conservative justices of the court signaled on October 15, their willingness to undermine another key section in the Voting Right Act, the 1965 landmark law enacted to prevent racial bias in voting. This was during arguments in a case involving Louisiana's electoral districts. The case centers on Section 2 of the Voting Rights Act, which prohibits voting maps that dilute the power of minorities without proof of racism. The lower court found that the Louisiana electoral map, which divided the six U.S. House of Representatives districts into two districts with a majority of Black people instead of one district previously, violated the Constitution’s promise of equality protection. The ruling is expected to be made by the end June. Federal Trade Commission Firing The conservative justices of the court have signaled that they will uphold Trump's legality in firing a Federal Trade Commission Member and give an historic boost to president power, while also putting at risk a 90-year old legal precedent. On December 8, the court heard arguments in the Justice Department appeal of the lower court's ruling that the Republican President exceeded his authority by dismissing Democratic FTC member Rebecca Slaughter before her term was due to end in March. The conservative justices seemed sympathetic to the Trump Administration's argument that tenure protections granted by Congress to heads of independent agencies illegally infringed on presidential powers under the U.S. Constitution. Trump was allowed to remove Slaughter until the case concluded. The court is expected to make a decision by the end June. TRANSGENDER SPORTS PARTIcipation The conservative justices seemed ready to uphold the state laws that ban transgender athletes to female sports teams despite escalating national efforts to restrict transgender rights. On January 13, the court heard arguments from Idaho and West Virginia in appeals of lower court decisions siding with transgender student who challenged the 'bans' in both states as a violation of the U.S. Constitution, and a federal antidiscrimination act. 25 other states also have laws similar to this one. The conservative justices expressed concerns over imposing a uniform law on the whole country, amid a sharp disagreement and uncertainty about whether medications such as puberty-blocking hormones or gender affirming hormones remove male physiological advantages in sport. The ruling is expected to be made by the end June. LGBT 'CONVERSION THERAPEUTY' During arguments on October 7, the court's conservatives appeared to be ready to support a challenge to a Colorado statute that prohibits psychotherapists from performing "conversion therapy," which aims to change minors' sexual orientation or gender identities. The law was challenged by a Christian licensed counselor under the First Amendment's protections from government?abridgment free speech. Colorado said that it regulates professional conduct and not speech and has the legal power to prohibit a healthcare practice they deem unsafe and ineffective. A lower court upheld this law. The ruling is expected to be made by the end June. HAWAII GUNS LAW The conservatives expressed skepticism about a Hawaii gun law which restricts handguns from being carried on public property, such as businesses. They appeared ready to expand the right to carry guns again. On January 20, the court heard arguments in an appeal by opponents of the law, backed by Trump's administration, regarding a judicial decision that Hawaii's Democratic backed measure is likely compliant with the U.S. Constitution’s Second Amendment right to bear arms. Hawaii's law demands that a property owner "expressly authorize" the bringing of a handgun on private property. Four other states in the United States have laws similar to Hawaii's. The ruling is expected to be made by the end June. Drug Users and Guns The Supreme Court will hear arguments in a case on March 2, involving a dual American/Pakistani national in Texas, to defend the Trump Administration's bid for a federal gun law that prohibits users of illegal drugs. Hunter Biden, son of former president Joe Biden, was charged under this law in 2023. The Justice Department appealed a lower court ruling which found that the gun restrictions were in violation of the Second Amendment rights to "keep and carry arms" guaranteed by the U.S. Constitution. The Gun Control Act, which was passed in 1968, prohibited gun ownership by drug users. CAMPAIGN-FINANCE On December 9, the court heard arguments in a Republican led bid to overturn federal spending limits by political parties coordinated with candidates. The case involved Vice President JDVance. The conservative justices seemed to be sympathetic towards the challenge. However, the three liberal members of the court appeared inclined to maintain the spending limits. The debate centers around whether federal limits on campaign spending coordinated with candidates' input violate First Amendment protections against government abridgment. Vance and Republican challengers have appealed the ruling of a lower court that limited how much money political parties could spend on campaigns, with input from candidates who they support. This type of spending is called coordinated party expenses. The ruling is expected to be made by the end June. MAIL-IN-BALLOTS On March 23, the court will hear arguments as Mississippi defends its state law that allows mail-in votes received after Election Day, to be counted. This case could lead to stricter voting laws in other states. A lower court declared illegal a state law allowing mail-in ballots received by certain voters that were stamped on or before Election Day, but not until five business days following a federal election. U.S. ASYLUM - PROCESSING: The court will hear arguments from the Trump administration on March 24, as it defends its authority to limit asylum processing at the ports of entry along U.S. - Mexico border. The Trump administration appealed the lower court's ruling that the "metering policy" was illegal. This allowed U.S. Immigration officials to stop asylum seekers and refuse to process their claims at the border. Former President Joe Biden rescinded the policy, but Trump’s administration indicated that it may consider resuming. Human Rights Abuses Abroad The court heard an appeal from Cisco Systems, in which the company and Trump administration asked the justices for a limit on the federal law used to hold corporations liable for abuses of human rights committed abroad. Cisco appealed the 2023 ruling which gave new life to a lawsuit filed in 2011 accusing the California-based firm of developing technology that enabled China's government monitor and persecute Falun Gong members. The Alien Tort Statute was the basis of the lawsuit. This 1789 law had lain dormant in U.S. courtrooms for almost two centuries, before attorneys began to use it in the 1980s in order to bring international human rights cases. Arguments in the case have not been scheduled. CRISIS PRINCIPAL CENTERS In a dispute arising from an investigation by the New Jersey Attorney General into whether or not these facilities engaged in deceptive practice, the court appears to be inclined to side with the Christian faith-based "crisis pregnancies centers" that are anti-abortion. During the December 2 arguments, a large majority of the Justices appeared to be inclined to revive a lawsuit filed by First Choice Women's Resource Centers against Democratic Attorney General Matthew Platkin's subpoena 2023 seeking information about the organization's doctors and donors. First Choice's facilities are designed to discourage women from getting abortions. The decision is expected to be made by the end June. RASTAFARIAN INMATES The conservative justices seemed inclined to reject the Rastafarian inmate's attempt to sue Louisiana state prison officials after they shaved his head in violation of?religious belief. The case was brought before the court in November 10 under a federal statute protecting incarcerated persons from religious discrimination. Plaintiff Damon Landor's religion requires that he let his hair grow. He appealed the decision of a lower court to dismiss his lawsuit, because they found that the statute in question did not allow for him to sue officials individually for monetary damages. The ruling is expected to be made by the end June. INMATE ON DEATH ROW The court heard arguments on December 10, in an attempt by Alabama officials, to pursue the execution a convict convicted of a murder in 1997 after a lower judge found him intellectually disabled. The Republican-led state has appealed a lower court ruling that Joseph Clifton Smith was intellectually handicapped based on his intelligence quotient (IQ), test scores, and expert testimony. In a 2002 Supreme Court decision, the court ruled that executing a person intellectually challenged violated the Eighth Amendment of U.S. Constitution prohibiting cruel and unusual punishment. The Supreme Court is expected to rule by the end June. WEEDKILLER CANCER CLAIM The court will consider Bayer's request to limit lawsuits claiming the German biotechnology and pharmaceutical company's Roundup weedkiller 'causes cancer' and possibly avoid billions of dollar in damages. Bayer appealed the ruling of a lower court in a case filed by a man claiming he was diagnosed as having non-Hodgkin lymphoma following years of exposure Roundup. The lower court rejected Bayer’s argument that U.S. pesticide law bars lawsuits based on claims made under state laws. Arguments in the case have not been scheduled. FCC FINES FOR WIRELESS CARRIER The Justices will hear the dispute over fines levied by the Federal Communications Commission against major U.S. carriers who shared customer location data with other companies without their consent. This is the latest case that has reached the Supreme Court challenging the authority of an American regulatory agency. The case concerns the FCC's efforts to impose tens-of-millions-of-dollars in fines on carriers like Verizon Communications and AT&T before they had their day in the court. Arguments in the case have not been scheduled. COX COPYRIGHT DISSERT The court heard arguments in December in an attempt by Cox Communications, a provider of internet services, to avoid financial responsibility in a major copyright lawsuit brought by record labels who accused Cox of allowing its customers to piracy thousands of songs. Justices appeared to be skeptical about Cox's claim that mere knowledge of user piracy was not enough for it to be held liable for copyright violations. A lower court ordered that a new trial be held to determine the amount of money Cox owes Sony Music Group, Warner Music Group Universal Music Group and others for contributing copyright infringement. Cox, which is the largest division of privately-owned Cox Enterprises said that the retrial may result in a verdict of up to $1.5 billion against it. The ruling is expected to be made by the end June.

-

As military buildups eclipse talks, the US and Iran are heading towards a conflict.

Officials on both sides, as well as diplomats in the Gulf and Europe, say that Iran and the United States have moved rapidly toward a military conflict. They are losing hope for a diplomatic resolution to the standoff they've had over Tehran’s nuclear program. Sources say that Iran's Gulf neighbours, including Israel, now see a conflict as more likely than a peaceful settlement. Washington is building one of the largest military deployments it has made in the region since the 2003 invasion of Iraq. Source familiar with the plans said that Israel believes Washington and Tehran are in a deadlock and has begun preparing for a possible joint military operation with the United States. However, no decision has yet been made on whether or not to conduct such an action. This would be the U.S.'s second attack on Iran in less than one year. The first was an airstrike by the U.S., Israel and other countries against Iranian military and nuclear installations last June. Officials in the region say that oil-producing Gulf nations are preparing themselves for a possible conflict, which they fear will spiral out of control and cause destabilisation of the Middle East. Two Israeli officials said they believed the gaps between Washington, D.C. and Tehran were unbridgeable. They also stated that there was a high likelihood of a military escalation in the near future. Regional officials claim that Tehran is making a grave mistake by refusing to make concessions. They also say that President Donald Trump is trapped by his military build-up and cannot reduce it without losing face. Alan Eyre is a former U.S. Diplomat and Iran Specialist. He said that "both sides are sticking with their guns" and that "nothing meaningful will emerge unless the U.S. "What Trump cannot do is assemble this much military and then return with a "so-so" deal and withdraw the military. He said: "I think he believes he will lose face." "If he attacks it will get ugly very quickly." TALKS HAVE STALLED Iran-U.S. talks stalled after two rounds on key issues from uranium to missiles and sanctions relief. Sources familiar with the talks say that when Omani mediators handed an envelope containing proposals from the U.S. on missiles, Iranian Foreign Ministry Abbas Araqchi did not even open it. He returned it. Araqchi, who spoke at the Geneva talks on Tuesday, said that the two sides had agreed upon "guiding principles" but the White House stated there was still distance. A U.S. official stated that Iran would submit a written proposal within the next few days. Araqchi, on Friday, said he expected a draft of a counterproposal to be ready in a matter of days. Trump, who sent aircraft carriers and warships to the Middle East on Thursday, warned Iran that it must reach a deal over its nuclear program, or else "really bad" things will happen. He seemed to have set a 10- to 15-day deadline, which prompted a response from Tehran that it would retaliate if the U.S. bases were attacked. Oil prices have increased due to the rising tensions. Officials in the United States say that Trump is still undecided about whether he will use military force, although he admitted on Friday that he might order a limited attack to try and force Iran to a deal. He told reporters, "I suppose I can say that I am considering it." It is not clear when an attack could occur. The U.S. secretary of state Marco Rubio will meet with Israeli Prime Minister Benjamin Netanyahu to discuss Iran on February 28, 2019. Senior U.S. officials said that it would take until mid-March for all U.S. troops to be in place. What's the endgame? European and regional officials are of the opinion that the size of the U.S. military deployment in the region will allow Washington to strike Iran while simultaneously defending its allies, Israel and military bases. The U.S. core demand is unchanged: No uranium enrichment in Iran. Iran says that it will not discuss ballistic missiles and insists on maintaining its nuclear capability. It denies that it is planning to build nuclear weapons. Defence analyst David Des Roches says that if talks fail, U.S. activities in the Gulf already signal how any strike would start: Blind Iran's Air Defence?and then attack the Revolutionary Guards Navy. This is the force behind decades of tanker attacks, and threats to shut down the Strait of Hormuz - the route used by a fifth of the world's oil. Some Arab and European officials say they don't know what Trump's ultimate goal is. And?European governments ask the U.S. for specifics on what it wants to achieve with its strikes - whether to reduce Iran's missile and nuclear capabilities, to prevent escalation, or to pursue a more ambitious goal such as "regime changes". Some European and regional officials are unsure whether military action will be able to change the course of Iran's ruling regime, which is led by Ayatollah Ayatollah Khamenei. The powerful Islamic Revolutionary Guards Corps protects the Supreme Leader. Some claim that because there is no apparent alternative political force in Iran, and the leadership's resilience is largely intact it would be dangerous to assume that strikes could lead to "regime changes". They say that military action is easier to start than control and harder to turn into a strategy. ARE CONCESSIONS LIKELY TO OCCUR? Few signs of compromise have been seen. Ali Larijani - a close advisor to Khamenei - told Al Jazeera TV Iran is willing to allow the International Atomic Energy Agency extensive monitoring to prove that it does not seek 'nuclear weapons. Tehran informed IAEA Chief Rafael Grossi about its decision. Sources familiar with the talks say that Iran's support for regional militias was not raised in formal talks. However, Tehran has no objections to U.S. concerns regarding proxies. Three regional officials reported that Iranian negotiators made it clear that Khamenei is the sovereign right to enrichment and missile production. David Makovsky, of The Washington Institute, said that each side is betting on the limits of the other. He said that Washington believed overwhelming force would force Tehran to yield. Tehran, on the other hand, believes Trump is not interested in a sustained campaign, and Israel, the gap between the two countries, was too large to close. This, he added, made confrontation inevitable. Steve Holland reported from Washington and Rami Ayyub in Jerusalem, Samia Nakhoul wrote the article, and Timothy Heritage edited it.

-

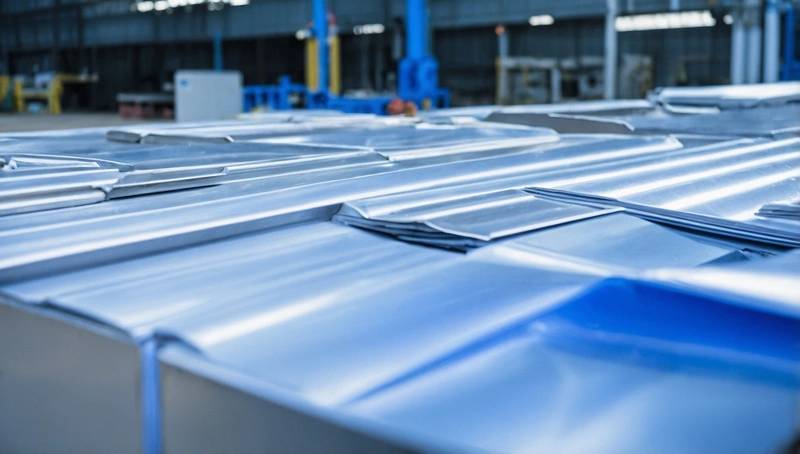

LME updates on the warranty of Russian aluminum in EU warehouses

London Metal Exchange (LME), a London-based exchange, announced that it would'suspend the warranting of Russian aluminum?in European Union warehouses (EU) from February 25 unless metal holder or members provide attestation demonstrating compliance with EU sanction. The announcement is made in light of the end of a transition period of one year after sanctions were introduced in February 2025. During this time, no Russian-origin aluminum?was warranted at EU locations. Russia is one of the major producers of aluminum. LME stated that only metals tied to contracts signed before 25 February 2025 and within a 50,000 metric tonnes quota could be placed on a "warrant" with formal attestation. The sanctions that were in place between February 25, 2025, and February 26, 2020 did not apply to Russian aluminum if it was imported into the EU at a level of less than 275,000 metric tons. The exchange also added that, from December 31, 2026 onwards, Russian aluminum?canonly be warranted by importers if they can prove that?the?material?entered the EU prior to that date in compliance with sanctions. The LME said that if the metal had been imported before December 31, 2026, but was not warranted, the LME would assess each request for the warranting of the metal in EU LME listed warehouses starting December 31, 2026.

-

Alberta to hold referendum on immigration control

Alberta will be holding a referendum in the fall to ask its residents if their government should limit "the number of" new international students and temporary foreign workers arriving in this oil-rich Canadian Province. Premier Danielle Smith announced the move in a television address on Thursday night. It was an attempt to take control of this important issue away from the federal government. Ottawa is responsible for the majority of immigration policy in Canada, and not the provinces. Smith is also trying to stop a growing Alberta separatist movement that has threatened Canadian unity, as Mark Carney tries to improve relations with the western provinces, rich in resources, to meet economic challenges brought on by President Donald Trump’s trade policies. Smith, a reporter on Friday, said that the government wants to give Albertans hope?that the Canadian Federation can work by allowing them to have a say in immigration policy. She said that if the citizen-led separatist initiative succeeds in gathering enough signatures, the question will be put to a vote. Smith stated that her government will face a significant budget deficit next week, due in part to a decrease in royalties from provincial resources as a result of lower oil prices globally. She also blamed Alberta’s fiscal problems on its exceptionally rapid population increase, which is the fastest in Canada. Statista Canada says that Alberta's population will surpass 5 million in 2025. In the last five years, it has grown by more than 600,000. This, Smith said, is putting strain on the province's resources. In her address, she stated that "throwing the doors wide open has led to a flood of people in our classrooms, emergency room and social support system, all at once." Gabriel Brunet is the spokesman of Dominic LeBlanc who is Canada's Minister for Intergovernmental Affairs. He said that the federal government took note of Smith's speech and had also taken steps to "regain control" over the immigration system. Brunet stated that "Albertans would express their views about these and other issues raised by Premier Smith as they did in the past on constitutional questions." According to ATB Financial, the main difference in population growth between Alberta and other provinces is that Alberta has an extremely high level of interprovincial immigration from Canadians looking for better housing and opportunities. Smith stated that "Albertans" identified international immigration in recent town halls as a top concern. She will therefore seek a mandate from a referendum to make changes. She said that the changes could include a new law mandating only Canadian citizens, Permanent Residents and individuals with "Alberta-approved immigration status" be eligible for programs funded by the province, such as education, health and social services.

-

US lawmakers prepare to vote on Iran war powers as Trump considers strikes

Congress may vote next week on whether to prevent 'President Donald Trump' from striking Iran without the approval of lawmakers. The U.S. Military is preparing for a possible serious conflict with Iran if diplomacy fails. Members of Congress have repeatedly tried to pass resolutions, which would prevent Trump from taking military action without the approval of lawmakers. The Constitution of the United States gives Congress, not the president, the power to send U.S. troops into war. The Constitution gives Congress the power to send U.S. soldiers to war, except for limited strikes to protect national security. Last week, it was reported that the military has been preparing to deal with the possibility of a sustained operation lasting weeks if Trump ordered an attack. Trump's Republicans have a'slim majority' in the Senate and House, and they've blocked these resolutions. They argue that Congress shouldn't restrict Trump's powers on national security. Democratic Senator Tim Kaine from Virginia and Republican Sen. Rand Paul of Kentucky have filed a Senate Resolution late last month that would block hostilities unless they were explicitly authorized by an official declaration of war. Kaine, in a Friday statement, said that if some of his colleagues supported war, they should vote for it and be accountable to their constituents rather than hide under their desks. On Friday, an aide to Kaine stated that there was still no date set for when the Senate might take up the resolution. Thomas Massie of Kentucky, and Ro?Khanna of California both said that they?planned? to force a vote next week on?a resolution similar. Trump officials claim that there is a 90% probability of an attack on Iran. Khanna wrote in a post at X.com that he couldn't do it without Congress.

-

MORNING BID AMERICAS-Oil engulfed

By Mike Dolan February 20th - What Mike Dolan, the ROI team and I are looking forward to reading, watching and listening to this weekend. Mike Dolan is Editor-at-Large for Markets & Finance Hello Morning Bid readers! The markets have had a strangely shortened holiday week. U.S., Canadian and Chinese exchanges were closed on Monday and the markets in South Korea and China were closed for much of the week to celebrate Lunar New Year. The news flow didn't slow down much. The surge in crude oil was probably the biggest macro-move of the week. The price of oil had fallen as U.S. - Iran talks and the parallel negotiations about the Ukraine war began in Geneva on Tuesday. Since then, however, with no tangible outcome and increased military activity in the Gulf and maneuvering, crude prices have risen 6% and are now at their highest level since August. Energy traders are wary about a disruption of supply in the Gulf, even if prices don't yet reflect this. There is little chance that sanctions-imposed Russian crude will return to the world market anytime soon. OPEC+ is reportedly leaning toward an increase in April production, but it's more than just supply concerns that are driving prices. In January, the U.S. manufacturing sector recorded its largest monthly increase in 11 months. This is in line with growing evidence that global economic growth picked up as we entered 2026. This industry's growth is not an isolated event. It goes hand in hand with the strong employment report from the same month. The Philadelphia Federal Reserve Business Survey for February registered activity levels almost double forecasts, and trade data from December showed an increase in U.S. Imports. This could be a sign of the hundreds of millions of dollars that Big Tech companies are planning to invest in AI by 2026. While markets await Nvidia's quarterly results, which are expected next week, signs were that the world's largest company was still closing big deals, this time with Meta, one of the so called hyperscalers. Meta has already announced that it will almost double its AI capital expenditure this year. There are concerns about the circular nature of investments made by a small group of high-tech companies. Nvidia is close to investing $30 billion in OpenAI, one of Nvidia's largest customers. Investors are also becoming more wary of what they believe to be AI overspending. And, new AI breakthroughs in the last month have caused existential concerns for companies from wealth managers to software firms. The picture is also clouded by a growing global backlash against social media's negative effects on children. S&P 500 stock trackers, the 'Magnificent 7' and Nvidia shares are all in the red this year. The private credit sector is also expressing concern that AI-related damage to the software industry could affect some funds. Blue Owl Capital shares fell 6% Thursday after the company announced that it was selling $1.4billion in assets to credit funds. This will allow it to return capital and pay off debt while also permanently stopping redemptions from one fund. Shares of other private credit firms were also affected. In macro markets, concerns over economic overheating were sparked by the recent oil price spike. Treasury yields rose throughout the week. The minutes of the January Fed meeting revealed that most policymakers had no plans to resume easing. There was also a split in opinion about whether AI would be able to test the capacity limitations in the economy before a disinflationary boom could occur. The Fed is facing a leadership transition, and while the Fed's inflation concerns are less acute in Europe at the moment, the European Central Bank could also be. The Financial Times reported that President Christine Lagarde could step down before the end of her term in October 2027. Reports cited the rationale that Emmanuel Macron would have a chance to choose her successor before he leaves his office in May next year. The ECB initially reacted to the report, saying that no decision had yet been made. However, ECB sources stated that Lagarde assured her colleagues she was not leaving yet. She told the Wall Street Journal on Friday that her baseline' is to finish her term. Still, names for her successor have circulated again. Former Spanish central banker Pablo Hernadez de Cos, the head of Bank for International Settlements and former Spanish bank chief, seems to be in front. However former Dutch central banks Klaas Knot or even Bundesbank boss Joachim Nagel have been mentioned as potential candidates. Other speculation about Bank of England eased after UK headline inflation numbers and private sector wage increases were soft. The fourth quarter GDP for the United States will be released on Friday, and some are watching for a possible Supreme Court decision regarding Donald Trump's emergency powers to impose tariffs. Trump's State of the Union address next week is likely to focus on his 'affordability drive' during the election year, and on Wednesday Nvidia will release its eagerly anticipated quarterly results. Energy markets will be closely watching the tensions around Iran this weekend, with Trump telling Tehran to reach a deal in 10 to 15 days about its nuclear program, or else "really bad" things will happen. Check out Open Interest for more news on commodities and markets. Find out which sectors will be the winners and losers when the U.S. reverses its climate policies. Also, learn how Big Tech and aluminium smelters are competing for power. Check out what the ROI team recommends you read, watch, and listen to as we enter the weekend. Please contact me at to let me know what you think. This weekend we are reading... RON BOUSSO is a ROI Energy Columnist. The Tony Blair Institute has published a report urging Britain to reset its energy policy. It argues that rapid targets for decarbonization could raise consumer prices. The report also recommends a greater use of domestic oil and natural gas along with net-zero goals. MIKE DOLAN is a ROI Finance & Markets columnist. In the January update of its CBO, it revised down its estimate for net immigration in 2025 by 1.6 millions from a year earlier, to 410,000. It also reduced its estimate for 2026 by 1 million. CBO says that although the gap between the current projections and the previous ones will close by 2030, without immigration the population will begin to shrink. A new Brookings study shows that the population growth rate in the United States had already dropped to the lowest ever recorded by 2024-25. GAVIN MAGUIRE is a columnist for the Global Energy Transition, a think-tank. A new paper by Ember argues that the current way of measuring "useful energy" in the world needs to be updated. Listening to... ANDY HOME: The ROI Metals columnist, Andy Home, is featured in this Power Current podcast hosted by Chris Berry, with Arnab Datt of Employ America, and Alex Turnbull of Critical Minerals Investor. This podcast offers an interesting discussion about securing supply chain and reducing dependence on China. It also discusses the role of stockpiling and price floors as well as tariffs. We're always watching... CLYDE RUSSELL is a columnist for the Asia Commodities & Energy Column of ROI. I was invited to join Gulf Intelligence’s Daily Energy Markets Podcast in order to discuss crude oil markets and the Iranian premium, and whether or not it's too much. Also, we discussed China's storage flow. Want to receive Morning Bid every morning in your email? Subscribe to the newsletter by clicking here. Follow us on LinkedIn, X and ROI. The opinions expressed by the authors are their own. These opinions do not represent the views of News. News is bound by the Trust Principles to maintain integrity, independence and freedom from bias. (By Mike Dolan).

Sources: Some Japanese buyers are willing to pay an extra $108/t for Q3 Aluminium.

Four sources said that some Japanese aluminium buyers agreed to pay an extra $108 per metric ton over the benchmark price, a 41% reduction from the current quarter. This was due to the weak demand and abundant supply.

This is a decrease from the $182 paid per ton in April-June. It marks the second consecutive quarter of declines and the lowest figure since the January to March quarter in 2024. The price is below the initial offers made by producers around the world of $122 to $145.00 per ton.

Japan is the largest Asian importer for premiums and light metals

Source at a trading firm said that despite concerns about the impact of U.S. Tariffs, so far the effect has been minimal and the premium has fallen sharply because supply-demand conditions are weak.

Three major Japanese ports have large stocks of aluminium

A second source from an end-user stated that "there was no significant change to local demand" but the local spot price has fallen during negotiations. It even reached $80, forcing producers abandon their initial offer.

Due to the sensitive nature of the issue, the sources refused to identify themselves.

Late May, Japanese buyers and global suppliers including Rio Tinto South32 began quarterly pricing discussions.

Some buyers are still in negotiation. (Reporting and editing by Tom Hogue; Yuka Obayashi)

(source: Reuters)