Latest News

-

Copper, aluminium drive higher after court rejects Trump tariffs

The prices of copper, aluminium, and other base metals rose on Friday as the U.S. Supreme Court overturned sweeping tariffs that were imposed by President Donald Trump in accordance with a law meant to address national emergencies. London?Metal Exchange benchmark 3-month copper increased 0.8% to $12,917 per metric ton at 1720 GMT. It had previously reached $12,985.50, its highest level in a week. Aluminium also rose 1.2% to $3103.50. The ruling is "constructive" for base metals, as it reduces the near-term risk to global trade flows and demand. The upside will likely be limited, however, given that some sector-specific duties are still in effect and other trade measures are possible," said ING commodities strategist EwaManthey. The?ruling did not affect U.S. Tariffs on Primary Aluminium, Copper Products and Steel since Trump didn't use the emergency law as a justification. He used Section 232 of the Trade Act to justify the metals tariffs. Manthey reported that aluminium had reached its highest level in a week earlier on investor concerns over constrained growth of supply. China, the world's largest producer of aluminium, recently met the annual production limit of 45 million tons set by the government. Meanwhile, another smelter in the U.S. has closed due to high electricity prices. Although volumes were muted due to the Lunar New Year holiday closure of the Shanghai Futures Exchange, the rest of the market did gain. The market will reopen on February 24. The price of copper has recently been impacted by?rising inventory. Stocks at LME-approved storage facilities grew to 235.150 tons Data?showed that Friday was the highest level of sales since March 2025. So far this year, inventories have risen by 65%. LME 'zinc' gained 1.1%, to $3,375 per ton. Nickel added 0.4%, to $17 350. Tin advanced 2.4%, to $46,740. Lead rose 0.6%, to $1,965.50. (Reporting and editing by David Goodman, Jon Boyle and Ishaan Verma Additional reporting by Ishaan rora and Swati rma in Bengaluru)

-

Businesses celebrate victory over Trump tariffs but refunds may take some time

The Supreme Court of the United States ruled that the White House emergency tariffs were invalid. This was a victory for thousands of businesses. The refund process?has just begun. The court's decision could have a ripple effect on the global economy. It ruled that Donald Trump cannot use the 1977 International Emergency Economic Powers Act in order to levy a broad?tariff on imports. The corporate world spent months adapting to Trump's constantly-evolving policy on trade and his use of tariffs to advance his agenda. Not only to address trade issues, but also to act as a weapon against the policies and actions of other governments. There are thousands of businesses that will now decide whether or not to seek refunds. This is because it's more than just a lawsuit. $175 billion Penn-Wharton Budget Model's economists stated on Friday that the tariffs collected in the U.S. could be refunded. The shares of the affected companies rose, from LVMH and Hermes to Italian luxury outerwear company Moncler. Consumer goods, automotive and manufacturing companies, as well as apparel manufacturers, have been particularly affected by the tariffs, since they rely on low-cost production from China, Vietnam and India. Trump's tariffs increase the cost of imported finished goods and components. This squeezes margins and disrupts finely-tuned global supply chains. Since April, more than 1,800 cases relating to tariffs have been filed at the U.S. Court of International Trade. This court has jurisdiction in tariffs and customs issues. In 2024, there were only a few dozen such suits. Plaintiffs include the Japanese motorcycle manufacturer Kawasaki Motors, subsidiaries of Japan's Toyota Group and U.S. big box retailer Costco. Also included are tire maker Goodyear Tire & Rubber as well as aluminum company Alcoa. Many lawyers believe that many other companies will join the lawsuits, as they waited for the ruling so as not to attract unwanted attention. The companies will join the queue of other companies that could wait for months or even years to recover billions in import duties. Lawyers have stated that the refund process will be long and those who filed early may get reimbursed more quickly. "Companies are faced with the challenge of collecting detailed import data in order to calculate the tariffs that were paid under different regimes which were applied at different times. Nabeel Yousef, a partner at Freshfields law firm, said that even multinational companies may not have their data organized neatly. He said that even with the ruling on Friday, "it's not like companies will start receiving checks in the post" on Monday. Tariffs are a burden on consumers who have already been drained by years of inflation following COVID. Last week, the Federal Reserve Bank of New York stated that 90% of Trump’s tariffs were paid by American companies and consumers. This was a response to the White House's claim that foreigners are responsible for the levies. According to the Yale Budget Lab, as of November, the U.S. effective tariff rate was 11,7%. This compares with a 2.7% average between 2022-2024. More suits coming? Some companies were initially reluctant to challenge the Trump Administration on tariffs. However, this attitude changed after the Supreme Court hearing held in November. During the hearing, several justices expressed doubts about Trump's legal reasoning for his expansive actions on trade. It is expected that the U.S. Court of International Trade will handle refund logistics. Trump officials have stated that they will continue to use lawful authority in order to levy duties, such as laws which allow the United States the ability to protect itself against unfair trade practices, or to shield sectors vital to national security. Tariffs will not disappear. "They're going to be under another umbrella," said Ted Murphy. Ted Murphy is the co-leader for Sidley's global trade, arbitration and advocacy practice. The automotive sector will continue facing significant tariffs that were not levied by the 1977 International Emergency Economic Powers Act. Last year, import tariffs of 25 percent were imposed on vehicles coming from Mexico or Canada. This was based on national security grounds. Attorneys say, however, that thousands of auto components shipped to the U.S. by?countries under Trump's reciprocal duties are likely being levied, increasing costs for parts suppliers and carmakers. Anticipating a long refund process, some U.S. firms have decided to sell their rights to receive refunds to investors. The companies will accept a small upfront payment - about 25-30 cents per dollar - and agree to give the remainder to investors if the tariffs are overturned. This was reported in December. DHL, a German logistics company, said it would use its technology to make sure that customers receive refunds "accurately and efficiently" when they are authorized. The companies have not yet confirmed whether they will lower prices to appease middle- and low-income Americans who have cut back on their spending due to rising costs. "We would certainly file for a reimbursement as I'm sure every other importer will do. I doubt that prices will drop. This rarely happens," said Jason Cheung CEO of Huntar Co., a small toymaker that is one of plaintiffs.

-

Andy Home: ROI-West must set its own prices to avoid China's control of rare earths.

The U.S. government's groundbreaking deal with domestic producer MP Materials has resulted in a sharp rise in the price for rare earths. The good news is that the U.S. government won't have to subsidise the MP Materials' production of neodymium & praseodymium(NdPr), as long as the prices remain above $110 per kilogram. Since signing the agreement with the Department of Defense in July of last year, the innovative floor-price system has protected the U.S. National?champion against low prices. DoD earns 30% of the price increase. The problem is that China sets the price reference. If the West is to break China's stranglehold on rare Earths, they need not only their own production base, but also their own market pricing mechanisms. CHINESE PRICING Power According to MP Materials' regulatory filing, the current reference point in the MP Materials-DoD deal is the ex works China NdPr Index compiled by Asian Metal. A competing Chinese agency, Shanghai Metal Market (SMM), is also referred to in the chart. China's dominance in the supply chain reflects its influence on rare earths prices globally. It is the largest physical market for critical metals required to make permanent magnets. Chinese pricing is inevitably accompanied by Chinese characteristics. By its nature, a Chinese ex-works will be a reference to the?dynamics of the Chinese market. They are diverging from the West's, where the West is trying to develop its own supply chain while China restricts exports. The way Chinese prices are set is even more problematic. AM and SMM both provide market data on industrial metals. Both must adhere to Beijing's legal framework, which is codified in its 1998 Pricing Law. According to a report from a U.S. Select Committee on China, published in November 2025? Select Committee on China "effectively makes illegal the publication of prices that differ from the PRC Government's wishes." Escape Clause The price mechanism embedded in the U.S. Government's agreement with MP Materials contains an escape clause. The DoD can choose to change the price reference from AM's assessment to the Chinese market if "an internationally recognized alternative index is developed which expresses the middle-market price of NdPr (Pr6O11 25%) and Nd2O3 (75%). Both Western price reporting agencies as well as exchanges appear to be aiming for this exact outcome. Benchmark Mineral Intelligence began collecting prices of rare earths sold outside China. The CME Group, as well as the Intercontinental Exchange, are also studying the possibility of rare earth futures. LITHIUM TEMPLATE Lithium is a good example of a template. Price swings at China's Wuxi Exchange, and more recently Guangzhou Futures Exchange have historically had a great impact on the Western market. The CME's development of futures contracts for lithium has reduced the dependence on Chinese prices. The first two years after the CME launched its contract for lithium hydroxide in 2021 saw a minimal turnover. Activity has increased rapidly since the Western market matured and both buyers and seller sought alternatives to Chinese exchange prices. CME volumes increased by 37% in 2025, and the January turnover reached a record of 19,590 contracts. CME has added to the original contract?with options contracts, a contract for lithium carbonate, and a contract for spodumene, creating an holistic supply-chain products suite. Chinese prices still influence Western pricing, as China is the largest market for lithium and rare earths. Western lithium companies no longer have to rely on Chinese price discovery. They now have the ability to hedge their risk and attract funding for new projects. TRANSPARENCY China's pricing power in critical minerals is due to its dominance in both the physical supply chain as well as in price discovery. For the West to be free, it must address both sides of the issue. The U.S. Geological Survey has designated 60 minerals as critical, including lithium and rare earths. To build Western supply chains, you need to create a market ecosystem that is complementary. The price of NdPr in China will determine the fate of both the U.S. taxpayers and government. Andy Home is a journalist. This column is a favorite of yours? Open Interest (ROI), a data-driven, thought-provoking commentary on the markets and finance is available at Open Interest. Follow ROI on LinkedIn, X and X. Listen to the Morning Bid podcast daily on Apple, Spotify or the app. Subscribe to the Morning Bid podcast and hear journalists discussing the latest news in finance and markets seven days a weeks.

-

Berlin can now take control of Rosneft German assets

The European Commission approved a new trusteeship on Friday that will give Berlin long-term control of the German assets owned by the Russian oil group Rosneft. This is part of the efforts to find a structural solution for the company. After the Russian invasion of Ukraine, Germany's long-standing energy relationship with Russia was shaken. It is necessary to renew the trusteeship every six months in order to?preserve energy security'. This creates uncertainty, mainly regarding the PCK Schwedt Refinery which supplies the majority of fuel to Berlin. The current trusteeship ends on March 10, 2019. The transaction that was examined by the?Commission under merger control laws relates to an 'indefinite trusteeship of the German Rosneft entities under national law,' a spokesperson for the Commission said. The shareholders of German Rosneft are prohibited from exercising their voting right for the duration the trusteeship. The decision on Friday essentially removed one regulatory obstacle to keep PCK Schwedt under German control, while the majority ownership remains with Rosneft. This carefully designed structure was intended to avoid any conflicts of interest. Expropriation Possible lawsuits related to the issue. The issue of the?U.S. sanctions is not addressed. Berlin last year imposed sanctions on 'Rosneft' as part of Washington’s efforts to squeeze Russia's oil sector. securing ?an exemption PCK Schwedt expires April 29. Last Month According to correspondence seen by, the management of the refinery privately informed Berlin that U.S. sanction were hurting their?business? and threatening fuel supplies?for the capital and the region. (Reporting from Christoph Steitz and Foo Yunchee, with additional reporting by Olesya Astakhova, and editing by Ludwig Burger, Thomas Seythal and Thomas Seythal).

-

Tata Motors India targets mass EV adoption through low-priced and fast-charging punch

Tata Motors' CEO stated that the company is confident its new, low-priced 'Punch EV' will be able to crack the 'dominant budget segment' of the third largest 'car'market in the world for electric vehicles. Approximately 65% of India's 4.6 million passenger cars sold last year had a price below $13,200. Just 1.6% of the affordable cars sold in India last year were EVs. In India, there are currently only a few EVs in the lower-price range. Shailesh C. Chandra, a reporter at the Reuters news agency, said that buyers are held back by concerns about their battery life and range and also because of their slow charging times. The entry segment is where the real challenge lies. Chandra stated that until we solve this problem, EVs will never be mainstreamed. The new Punch EV starts at $10,650. A?long range variant, which can travel 350 km (217 miles), on a single battery charge, is available for $13,850. According to the company, The Punch can charge?from 20% battery level up to 80% within 26 minutes using a fast charger. It also comes with a warranty for life on its battery. Tata also offers an option that decouples the price of the EV from the battery. This reduces the upfront cost of the EV to $7,100. The battery is then paid separately at 3 cents per km. GOVERNMENT WANT MORE EV ADOPTATION, BUT SALES ARE LAGGING India's government wants to see EV sales increase to 30% by 2030, from only 5% currently. This will reduce India's dependency on imported fuels and help to lower pollution levels in its cities. However, EV growth has slowed down, forcing carmakers to offer discounts. Chandra stated that Tata Motors sacrifices margins on its EV line "to an extent" to ensure long-term progress toward electrification. However, he added that profits were 'not far below the combustion engine car business. He said that "EVs are no longer an experimental play, but a serious one." Tata is India's biggest?seller? of electric vehicles. It competes with SAIC India, JSW MG Motor and Mahindra & Mahindra. Maruti - Suzuki, India's largest car manufacturer, is the newest to enter the EV sector with its eVitara SUV. Its base model, which leases the battery separately, starts at around $12,000, while the long-range version costs $22,000. (Reporting and editing by Joe Bavier; Aditi Shah is the reporter)

-

Oil prices rise as US-Iran tensions increase oil prices. Global stocks remain steady, with risk appetite remaining firm.

Global shares remained steady on Friday as traders considered the heightened tensions surrounding a possible conflict between Iran and the United States, which has helped to 'push oil prices up to their highest level in six months. The STOXX 600 pan-European index rose?0.5%, and is on track to have its fourth week of gains. Futures for the S&P 500 index in the U.S. remained flat. Investors will be battling a mix of geopolitical risks, economic signals, and political flashpoints as the session concludes a volatile global asset week. Mabrouk Chetouane is the head of global strategy at Natixis Investment Managers. They are still focusing more on economic fundamentals than geopolitical risk. When you examine metrics like valuations, earnings, and interest rate expectation, things seem to be stable. According to LSEG data, as of Wednesday, 163 of the?STOXX 600 companies had released their quarterly results. Of these, 57.1% were above analysts' expectations. The data shows that in the S&P 500, 73% of companies who reported earnings last week exceeded revenue expectations. Nvidia will report its earnings next week, which will be the main focus of markets. Investors will also be analyzing global business activity surveys and fourth-quarter U.S. gross domestic product numbers. They'll also be examining the Federal Reserve’s preferred inflation measure, the core personal expenditures price index. DOLLAR NOTCHES WEEKLY GARANTIE The dollar is headed for its biggest weekly gain in four months in foreign exchange trade thanks to a patchwork a slightly better U.S. economic data and Fed minutes that suggest policymakers are not in a hurry to lower rates. The dollar has gained about 1% against the euro this week, pushing it to $1.1768. Francesco Pesole, ING FX's strategist, said that the dollar's "safe-haven appeal" is generally reduced but fully restored when oil shocks are triggered by geopolitical tensions. The yen fell in Japan after data revealed that core inflation in the country was at 2%, its lowest rate in two years. This could complicate the central bank's path of raising rates. The dollar has gained 1.7% this week and is now trading at 155.22yen. U.S. Treasuries remained steady with 10-year yields of 4.07%. However, the Fed minutes showed a division over how quickly to reduce rates. This has pushed up two-year yields to 3.47% over the past week. The yields on Germany's 10-year Bunds (the euro zone benchmark) are on course to decline by 2 basis points this week. OIL SURGES ON US MILITARY BUILDUP Benchmark Brent crude futures reached 6-1/2-month highs above $72 per barrel as U.S. president Donald Trump set an Iranian deadline of 10 to 14 days to reach a 'deal' over its nuclear program, or else "really bad" things would happen. The political rhetoric has escalated dramatically. "Even a limited disruption or credible threat to shipping lanes can cause an immediate shock in supply," said Capital.com Senior Market Analyst Daniela Hathorn. Kenji Abe (chief strategist, Daiwa Securities, Tokyo) said that investors were hesitant to take risks after the news. Brent Donnelly, President of Spectra Markets, said: "There doesn't seem to be any point in increasing risk before this weekend's unrest surrounding the Middle East." Today feels like a great day to avoid trouble." Reporting by Niket Nishant in London and Tom Westbrook, Singapore; editing by Shri Navaratnam and Jane Merriman

-

INDIA BONDS - Indian 10-year bond yields surge most in the past two weeks due to US-Iran tensions

The yield on India's 10-year benchmark government bond spiked Friday due to mounting concerns about a possible military confrontation between the U.S. India is a net importer of energy, and higher crude oil prices pose a major risk. The benchmark 2035 bond yield of 6.48% settled at 6.9214 percent on Friday, up more than 4 basis points, the biggest increase in two weeks. Bond yields are inversely related to prices. Donald Trump, the U.S. president, issued a fresh warning on Thursday, urging Iran's nuclear programme to reach a deal. He set a deadline of?10-15 days, prompting Tehran to threaten retaliation if U.S. bases were attacked. Benchmark Brent Crude futures reached nearly $72 per barrel on Friday. This was their highest since July 31. Alok Singh is the head of treasury for CSB Bank. He said that with?global tensions brewing, some positions were unwinding before the weekend. If there is no further escalation of tensions, crude oil prices could drop and yields could retrace. Traders said that aggressive paying of overnight index swaps because of the weakening?rupee, and the rising crude price also dampened the sentiment on the debt market. Separately New Delhi raised 330 billion rupees ($3.62billion) earlier in the day through the sale government bonds, at yields that were?2-3 basis point above market levels, deepening the selling and sending the 10-year rate to the 'day's highest of 6.73411%. The rate of India's OIS 5-year bond jumped the most in two weeks, a move influenced by tensions between the U.S. and Iran. The two-year OIS rate increased?about 3bps to 5.65%. The five-year OIS rates jumped about 5.5 bps, to 6.0950%.

-

Sibanye CEO: Sibanye committed to battery metals even though lithium is impaired

Richard Stewart, CEO of Sibanye Stillwater, said that the company is committed to its 'battery metals' business. This comes after an impairment of another 2.46 billion rand (about $152.6 million) on its Keliber Lithium project in Finland. In recent years, the South African miner has acquired zinc, nickel, and lithium assets as part of a shift to metals that are used in renewable energy technologies. Sibanye recorded a total impairment of 7,8 billion rands at Keliber by 2025. The company cited a "dim outlook for long-term prices of lithium hydroxide". The asset is currently valued at around 9 billion rand by the company. The company cancelled its plans to invest in the Rhyolite Ridge Lithium project in the United States in February 2025. After the?metal price dropped. Stewart stated during a call to discuss results that "our long-term strategic goal as a business is to continue to provide metals to support the decarbonisation of our planet and energy transition". PRODUCTION PHASED Sibanye will phase-in production at Keliber starting with spodumene, and then consider producing battery-grade lithium hydroxide at a later date, depending on price. Stewart stated that the European Union's and U.S.'s initiatives to reduce their reliance on China as a source of battery metals provide an incentive for Keliber. He said, "We believe this will have an impact on the final pricing layout in time." Sibanye announced on Friday that its headline earnings for 2025 were 2.44 rand per share, compared to 0.64 rand in the previous year. This was boosted by higher prices of gold and platinum group materials. This helped the diversified miner announce its first dividend since 2023. The average South African PGM price rose by 28% and the rand price increased by 39%.

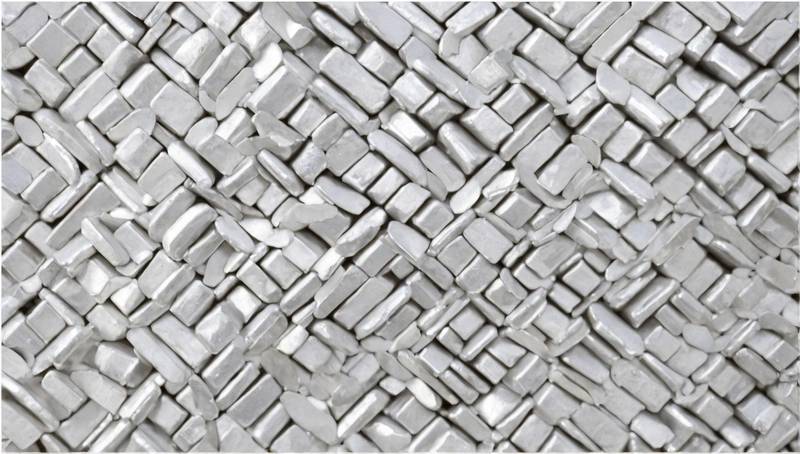

Zinc reaches peak in 4 months as LME availability declines

The London Metal Exchange reported that more than half the stocks stored in their approved warehouses were marked for removal.

Benchmark zinc traded on the LME 0.7% higher, at $2,838 per metric ton. It had previously reached $2,876 per ton, its highest level since March 28.

The total stocks of zinc at the LME are 118,225 tonnes

Traders say that there are concerns about how much zinc will be removed from the LME's warehouses, as most of it is stored in Singapore.

Rent deals are agreements that allow warehouses registered on the LME to share their fees or rental revenue with companies who deliver metal.

Natalie Scott-Gray is a senior metals analyst with StoneX. She said: "It's unclear whether this latest volatility in stocks was driven by pure physical demands or market players who benefited from rent deals."

If we don't see the same quantity of material return to the market in the next 3 to 4 weeks, we can assume this latest order will at least partially satisfy the physical consumption needs in Europe.

The focus is also on large holdings of 0#LMEWHI> zinc warrants, which are title documents that confer ownership. Additional cancellations will add to the tightness that has been created.

The announcement by China that the construction of what is expected to be the largest hydropower project in the world, located on the eastern edge of the Tibetan Plateau at a cost estimated at at least $170 billion has begun, traders reported, provided a boost to zinc.

The plans of China, the world's largest consumer, to stabilize growth in the sectors of machinery, automobiles, and electrical equipment, have helped industrial metals grow.

Lead fell 0.3% and aluminium rose 0.5%. Tin was up 0.9% to $33,750. Nickel climbed 1.4% to $16,430 per ton. (Reporting and editing by Jan Harvey, Louise Heavens and Pratima Dasai)

(source: Reuters)