Latest News

-

IAEA: Ukraine’s Zaporizhzhia Nuclear Power Plant operates on the sole remaining main electricity line

The U.N. nuclear watchdog reported on Thursday that the Russian-owned Zaporizhzhia?power station in southeast Ukraine was operating 'on its only remaining outside powerline after losing a backup line a little more than a week ago. Rafael Grossi said in a statement that the Ferrosplavna-1 electrical line was shut down on 10 February "apparently as a result" of military activity. He said that the plant, which is?Europe's biggest with six reactors?, now operates with only outside power?from Dniprovska, he added. The plant was captured by Russian forces in the first few weeks of Moscow’s invasion of Ukraine. It does not generate electricity, but it needs to be powered up so that?nuclear materials can remain cool and avoid a meltdown. Russia and Ukraine accuse one another of military activities near nuclear plants that could threaten safety. Last year, the two external lines of the plant were down for nearly a whole month. Grossi stated that IAEA monitors permanent assigned to Zaporizhzhia tried to get information about?the damages, but security restrictions prevented access to the?switchyard of the plant. Grossi stated that the IAEA is ready to report accurately on the nature of damage and the impact on nuclear security and safety. The control of the plant is an important point in the negotiations between Ukraine and Russia to'resolve the conflict that has lasted for nearly four years. Kyiv's proposal that the Zaporizhzhia power plant should be run by Ukraine and America is rejected by Russia as unacceptable. Reporting by Chandni in Bengaluru, Ron Popeski and Cynthia Osterman; editing by Cynthia Osterman

-

Consolidated Edison's quarter profit misses estimates due to higher operating and interest costs

Consolidated Edison, hurt by higher operating and interest costs, missed Wall Street's expectations for the?fourth quarter profit? on Thursday. Interest rates that are higher for longer can increase borrowing costs. Operating expenses for the company rose to $3.51 billion in the third quarter, up from $3.16 billion a year ago. Interest?expenses rose from $304 to $313 millions, up from $304 millions a year earlier. According to LSEG, the 'New York-based utility' posted an adjusted profit per?share of 89 cents for the three months ended December 31. This compares with analysts' average estimates of 95 cents. The company anticipates capital investments of approximately $6.56 billion in 2026, and $6.76 in 2027. The company expects a full-year adjusted profit of between $6 and $6.20 per share. ?Analysts expect a profit $6.03 per share. Kirk Andrews, CFO of the company, said: "We expect adjusted profit per share to grow by 6 to 7 percent annually over the next five years using our 2026 adjusted EPS guidance as a benchmark." (Reporting from Sumit Saha, Bengaluru. Editing by Alan Barona.)

-

Sources say that Venezuelan refineries are able to process at 35% capacity.

Workers at the facilities reported that the Venezuelan refining system is running 'at around 35% of its capacity installed of 1.29 million barrels a day. This is higher than the 20% to 25% of last year but still a small volume for securing enough fuel to satisfy the rising domestic demand. Refineries in South America, run by the state-owned energy company PDVSA are often hit by power failures and malfunctions, which limit fuel supplies to homes, power plants, and vehicles. Venezuela was forced to ration cooking gas, gasoline and diesel in the past. According to sources, Amuay Cardon?El Palito Puerto la Cruz refineries processed together 450,000 bpd Venezuelan crude last week. PDVSA, however, is working to keep its key fuel-making facilities in operation. After recovering from an earlier power outage that had taken one of the refineries, Amuay's, out of operation,?the largest complex in the country, The 955,000-bpd Paraguana?Refining Center?, has seen total crude processing?rise to 287,000bpd?at five distillation units. The workers at its second refinery Cardon said that it was restarting an important gasoline-making facility on Thursday. Two distillation units at the Puerto la Cruz refinery processed 82,000 bpd of crude oil. Sources say that at El Palito's 146,000 bpd plant, one distillation unit processed 80,000 bpd while its fluid catalytic cracked 35,000 bpd. The?state-owned company's oil output has recovered to around 1 million bpd after the majority of production cuts were ordered during a U.S. blockade. The blockade was reversed and some of the crude upgraders in the Orinoco Belt region of the country, which is the main oil producing region, have been reconfigured to ensure feedstock for the refineries. Under new?U.S. Following the capture of 'President Nicolas Maduro', Venezuela has begun importing U.S. naphtha to supplement its domestic fuel production.

-

Oil prices close at a six-month high amid US-Iran tensions

Oil prices rose by around 2% to their highest level since six months on Thursday, as traders were concerned about escalating tensions in the Middle East, where the United States and Iran have increased military activity. Brent crude futures closed up $1.31 or 1.9% to $71.66 a barrel, while U.S. West Texas intermediate crude closed up $1.24 or 1.9% to $66.43. Brent closed Wednesday at its highest level since July 31 while WTI closed its highest level since August 1. Andrew Lipow, President of Lipow Oil Associates, said that oil prices were boosted by "geopolitical turmoil and the fear that the U.S. will strike (Iran), in the near future." The market will continue to rise in anticipation of some event. Iran is planning a joint naval drill with Russia, Iran's semiofficial Fars News Agency reported. This comes days after Iran closed the Strait of Hormuz to military drills for a short time. The Strait of Hormuz is a vital trade route, as about 20% global oil supplies pass through it. TRUMP WARNS IRAQ U.S. president Donald Trump warned Iran that it must reach an agreement over its nuclear program, or else "bad things" would happen. He appeared to have set a deadline of 10 days before the U.S. The U.S. may take action. U.S. Vice-President JD Vance said Washington was evaluating whether to continue diplomatic engagement with Tehran, or pursue other options. According to the U.S. Federal Aviation Administration's website, Iran sent a warning to its airmen about the planned launch of rockets in the southern part of the country. Some countries have asked residents to leave Iran. Saudi Arabia's crude oil exports, the largest oil exporter in the world, dropped to 6,988 million barrels a day on Thursday, the lowest level since September. The data was provided by the Joint Organizations Data Initiative. Earlier in the month, it was reported that OPEC's producer group and its ally countries were leaning towards a resumption to increase oil production from April. On?Wednesday, two days of peace negotiations between Ukraine and Russia in Geneva ended without a breakthrough. Ukrainian President Volodymyr Zelenskiy blamed Moscow for stalling U.S.mediated efforts to end the war that has lasted four years. U.S. crude stock dropped by 9,000,000 barrels as refining and exports increased. This was in contrast to the poll results which predicted that crude stock levels would rise by 2.1m barrels for the week ending on February 13. The higher demand for gasoline and distillates also led to a drop in inventories last week. Phil Flynn is a senior analyst at Price Futures Group. He said, "We saw a drop in prices because we had a build-up last week due to weather storms." "We have a strong market with a solid demand, and that should support (prices) until the end."

-

Southern Co increases its spending plan by 7 percent as the demand for data center electricity grows

Southern?Co increased its five-year budget by 7%, as the U.S. South's largest electric and gas utility sells more electricity. U.S. utilities have invested heavily in upgrading electric grids as a result of extreme weather, the growing demand for power from data centers dedicated AI and cryptocurrency and a shift among homes and businesses to electric heating and transportation. Southern Co CEO Chris Womack told investors that the country and the energy industry are at a "watershed moment". Southern Co plans to spend $81 billion between 2026 and 2030, up from its previous five-year budget of $76 billion. About half of this spending will go to increasing power generation. The Atlanta-based utility announced that it has contracted with 10 gigawatts from large-load clients in Alabama, Georgia, and Mississippi. These customers include Google, Meta and Microsoft, as well as Compass Datacenters. Its shares rose by more than 4% during the afternoon trading. Executives said in a call with investors that data centers with a demand totaling 75 gigawatts expressed an interest in connecting with Southern Co's system. A gigawatt can power approximately 750,000 homes. Southern Co, as part of its plans to increase its?power supply, said that it could redirect about 1,000 megawatts in natural gas-fired generator capacity to new customers by 2030. The company is in the final stages of discussions about increasing the output from its natural gas fleet, which would create 700 additional megawatts. Nicholas Amicucci, Evercore ISI analyst, said: "Southern is continuing to take advantage of its growth opportunities with prudence." Shares of the utility should rise due to its capital expenditure and earnings outlook, but still maintain upside potential given that it serves the Southeast U.S. Southern Co, the second largest utility in the United States, has 9 million customers spread across Alabama, Georgia Illinois, Mississippi, Tennessee and Virginia. Extreme weather conditions and the growing population in the U.S. South also contribute to increased power consumption. According to Southern Co, a winter storm in early January was responsible for the "second-highest peak winter electric load" on its system. On Thursday, the Southern?Co also forecast an adjusted annual profit that was below analyst's estimates. Southern Co's adjusted profit per share for the quarter ending December 31 was 55 cents. This is below analysts' expectations of 57cents, as compiled by LSEG. Operating expenses rose 14.7% during the quarter while revenue increased 10%. The company estimates that its adjusted profit in 2026 will be between $4.50 to $4.60 per share. However, the midpoint is slightly lower than the estimated $4.56. Reporting by Vallari Shrivastava from Bengaluru, and Laila KEARNEY in New York. Editing by Shilpa Majumdar and Lisa Shumaker.

-

Imerys cancels UK Lithium Project to Focus on France

Imerys, the minerals group, announced on Thursday that it has halted its project to develop lithium production in Britain. Instead, they will focus on a more advanced venture in France. Imerys British Lithium's project in Cornwall (southwest England) aims to produce over 20,000 tons of lithium carbonate annually and potentially meet the lithium demand for 500,000 electric vehicles. Imerys, in its annual report, said that it had placed the project under care and maintenance. It has suspended active development. "We realized that managing two projects in two countries at the same time was a lot," CEO Alessandro Dazza said to reporters during a conference call. "We will focus on France, where we are more advanced." Imerys announced 'last week that the French government would invest 50 millions euros ($59million) for a minority stake in a project called 'Emili,' located in central France. The project is aiming to produce 34,000 tons of lithium hydroxide a year by 2030. Dazza refused to provide a timeline on when the "British Project" would resume. Imerys said that the project remained "strategic valuable" after the recent completion a scoping report.

-

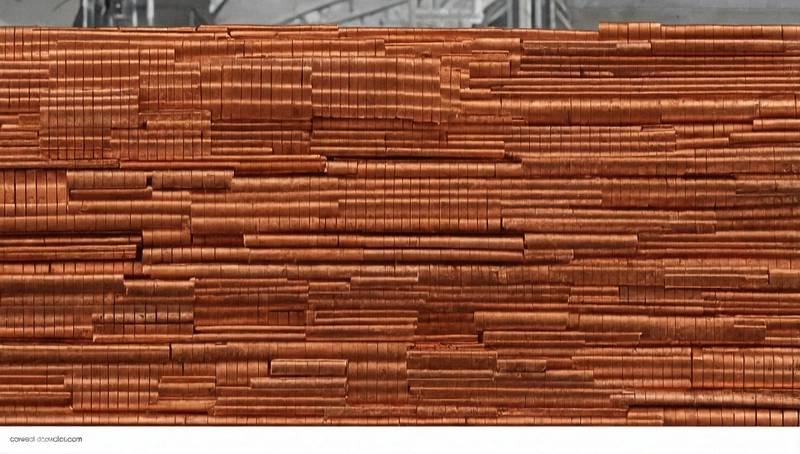

Copper prices fall as a firmer dollar and large inventories weigh

Copper prices fell on Thursday as the firmer dollar, rising inventories and lower demand due to the Lunar New Year holiday, in China, which is the world's largest metals consumer, all weighed on the price. As of 1700 GMT, the benchmark three-month copper price on London Metal Exchange had fallen 0.9% to $12,789 per metric ton. The price of copper fell by as much as 1.9% in the morning session, following a 2.3% increase on Wednesday. The Shanghai Futures Exchange, which will reopen on February 24, is currently closed. Ole Hansen is the head of commodity strategy for Saxo Bank. "We must get China back to see what will happen, both on a speculative level and also in terms of physical demand." DOLLAR PRICED METALS GET MORE EXPENSIVE After minutes from the U.S. Federal Reserve, which suggested that policymakers weren't in a hurry to reduce interest rates and were willing to raise them if inflation remained high, the dollar index rose. Dollar-priced metals become more expensive to holders of other currencies when the dollar strengthens. Copper stocks at LME-approved warehouses The total tonnage of 225,575 tonnes, the highest since March 2025, has increased by 925 tons. Hansen stated that technicals were able to offset the negative impact of the high stock and the 'firmer dollar. Copper was also'supported by technicals. He said that "since last August, the 50-day moving averge has been giving us support every time we've come down." He said that the minimum support level was $12,670 and the maximum psychological resistance is $13,000. Other metals saw a 0.5% drop in zinc to $3335 per ton, and aluminium fell by 0.9% to $ 3,062.50 after breaking Wednesday's four-day loss streak. Lead fell 0.4% to $1.955; nickel dropped 0.2% to $17240, and tin declined 0.6% to $45,425. (Reporting and editing by Alexandra Hudson; Additional reporting by Ishaan arora in Bengaluru, Swati verma and Barbara Lewis; Shrey Biswas and Barbara Lewis)

-

FTSE 100 drops as Rio Tinto disappoints, US-Iran tensions are a factor

London's FTSE 100 fell from its record highs on Thursday as Rio Tinto shares dropped after the global mining company's earnings missed expectations. Meanwhile, simmering tensions between the U.S. and Iran kept investors wary. Blue-chip index dropped 0.5%, after two consecutive sessions of closing at record highs. The mid-cap FTSE 250, which is primarily focused on the domestic market, was down by 0.4%. Rio Tinto dropped 3.6% following the miner's?reporting flat annual earnings. Lower prices at its iron ore business, its mainstay, were offset by a strong performance?in its copper division. Other London-listed companies also fell as copper prices were 'hit by a stronger dollar, increasing inventories, and reduced demand because of the Lunar New Year holiday in China. Axel Rudolph is a senior financial analyst with IG. He said: "A stronger US Dollar - at one month highs amid flight to safety flows - added additional pressure on precious and basic metals. This weighed on UK mining stocks and impacted the FTSE 100’s stellar performance." Oil prices have risen by over 2% as investors around the world are unnerved by tensions between the U.S. and Iran regarding Tehran's nuclear programme. Investors looking to diversify away from U.S. stock that has been under pressure?by AI disruption concerns have been a major factor in the UK's stocks finding a?broad support?. British Gas's Centrica, which owns British Gas, was the largest faller in the blue-chip index on Thursday. It had warned that its 2026 profit forecasts at its energy trading arm would be missed and halted its share buyback program after reporting a 39% decline in annual profits. (Reporting by Tharuniyaa Lakshmi in Bengaluru; Editing by Mrigank Dhaniwala, Kirsten Donovan)

Copper prices rise on positive US data and China's demand expectations

Copper prices on the London Metal Exchange and the Shanghai Futures Exchange rose on Friday, supported by stronger-than-expected U.S. economic data and expectations of increased Chinese buying after the recent price dip.

The most traded copper contract on SHFE gained 0.5%, to 78.290 yuan per ton. However, it was still 0.19% down this week.

The U.S. data is encouraging and has boosted the hopes for better demand for copper. This also reduces the likelihood of immediate interest rate reductions, according to a metals analyst in Beijing at a futures firm.

Retail sales in the United States increased by 0.6% in June, after a 0.9% decline in May that was not revised. The number of Americans who filed new unemployment benefit applications fell last week. This indicates that job growth has been steady so far this month.

The LME copper stock has been increasing, especially at its Asia warehouses, as traders are betting that China will buy more with the recent price drop, but it is unclear whether or not this will happen.

The total copper stock at LME registered warehouses

The market is still waiting for the confirmation of the deadline of August 1, and the details of the U.S. 50% tariff on copper imports.

LME tin rose by 0.47%, to $33,170 per ton. Aluminium gained 0.41%, to $2,588.5. Lead climbed 0.28%, to $1,978.5. Zinc advanced 0.24%, to $2,743.5. Nickel fell 0.04% to $16,090.

SHFE zinc rose 1.18%, to 22,340 Yuan per ton. Tin gained 0.77%, to 263,760 Yuan. Nickel grew by 0.67%, to 120,430 Yuan. Aluminium grew by 0.47%, to 20,520 Yuan. Lead dropped 0.3% to 16 820 yuan.

Click or to see the latest news in metals, and other related stories.

Data/Events (GMT 1230 US Housing starts Number June 1400 Preliminary US U Mich Sentiment July (Reporting and Editing by Sumana Niandy; Reporting by Hongmei LI)

(source: Reuters)