Latest News

-

SGH and Steel Dynamics bid $10.6billion for BlueScope Steel, but investors are still wary

BlueScope Steel, an Australian steelmaker, said that it is considering a "sweetened" A$15 billion (10.62 billion dollars) takeover offer from U.S. based Steel Dynamics and SGH Ltd. However investors are still unsure if a deal will go through. SGH, owned by media billionaire Kerry Stokes and Steel Dynamics, said that they would now pay A$32.35 for each BlueScope Share in cash. They called it their "best-and-final" offer unless another rival bid is made to purchase all or part the steelmaker. The bid includes recent dividends and is valued at A$34 for each share. BlueScope's shares are trading 1.9% above the offer price at A$28.56. This is well below the bid, and indicates that investors have doubts about a successful deal. SGH shares rose 1.2% to A$47.39 while the S&P/ASX200 was up 0.5%. Joseph Koh is the portfolio manager at Blackwattle Investment Partners. He is an investor with BlueScope and SGH. This offer is clearly higher than the original so... it's likely they will accept. "I think there's more than 50% of them rejecting it. That is what the market appears to be pricing." BlueScope announced on Monday that it expects to return up A$3 to investors per share in the current fiscal year. This includes a A$1 special dividend per share and a buyback on the market. The steelmaker has doubled its interim dividend A nearly 120% increase in the first-half net profit to A$391 millions. BlueScope’s board argued that SGH and Steel Dynamic’s first offer undervalued BlueScope, its future prospects and the land bank it valued at approximately A$2.8 billion. John Ayoub is the portfolio manager at Wilson Asset Management, which also invests in both Australian shares. But I think that the number of A$34 is enough to close a deal. We believe that at A$34 they should be able to move forward with a final deal. BlueScope said that it would take into consideration the valuation proposed, the conditions and execution risks. Analysts said that despite the higher price BlueScope would likely be seeking a price over the new offer. RBC analysts wrote that they did not believe a price increase of +13% would be enough to close the gap between the previous offer and the Board's fundamental value. "Our implied mid-cycle value is around A$30 per share, and an offer must be at least this level in order to be successful." AustralianSuper, with its 13.52% stake in the steelmaker, declined to comment. It backed BlueScope in rejecting the previous offer last month, saying that it "very substantially undervalued" company. SGH and Steel Dynamics maintained on Wednesday their plan to split up the Australian steelmaker into geographical units -- SGH would take over the Australian operations, and Steel Dynamics would get the North American unit. Steel Dynamics, based in Indiana, has assets located about?90 km (50 mi) away from BlueScope’s plant in Ohio. Steel Dynamics' proposal to purchase Australia's biggest steel producer was first announced in December. The move comes at a time when the steel industry is grappling with U.S. president Donald Trump's steel tariffs.

-

Oil down after US-Iran talk, but Asia stocks are up despite AI concerns

The Asian stock markets rose?on Wednesday, despite renewed concerns about artificial intelligence that gripped international markets. Oil prices also fell after Iran announced?progress made in its nuclear negotiations with the United States. The New Zealand dollar fell after the central banks said that monetary policy must remain accommodative to support economic recovery. The Nikkei 225, Japan's benchmark index, rose 0.93%, to 57 090.14, poised for a turnaround after a three-day slide, while Australia's S&P/ASX200 gained 0.5%. Mainland China, Hong Kong and Singapore were all closed during the Lunar New Year holiday. Investors grappled Tuesday with the AI boom outlook, which led to a lacklustre Wall Street session. Investors have been jittery in recent weeks due to concerns that companies overinvest,?alongside angst regarding the extent of the potential disruption labor markets could face from the emerging technology. Overnight in the U.S., the Dow Jones Industrial Average rose by 0.07%, to 49,533.19; the S&P 500 gained 0.10% to 6,843.22; and the Nasdaq Composite grew 0.14%, to 22,578.38. The S&P fell by 0.88% initially before gaining ground and closing in positive territory. On Wednesday, the yield on 10-year U.S. notes was unchanged at 4,054%. The 30-year bond rate fell 0.4 basis point to 4.6788%. NAB analysts stated that "AI uncertainty" remains a source for volatility. This is because it's difficult to determine which AI companies are going to be winners or losers, as well as what impact AI will have on other businesses and sectors. Brent crude oil and West Texas Intermediate crude were barely changed at $62.32 and $67.42 per barrel on Wednesday, respectively. Both had closed at more than two weeks' lows the previous session. After talks in Geneva, Iran's Foreign Minister said Tehran and Washington had reached an agreement on the main "guiding principles" for resolving their long-standing nuclear dispute. This eased concerns about a possible military conflict near Strait of Hormuz, which could disrupt global supply of oil. Silver was also down around the same amount to $73.30 an ounce. Analysts at ANZ said that "gold prices fell as a stronger U.S. Dollar weighed on markets, and declining U.S. Treasury Yields provided little support." Investors remain 'uncertain' amid a subdued trading environment in Asia. The prospect of geopolitical tensions easing with positive results from the Iran-US negotiations in Geneva weighed on demand for haven gold. The dollar index, which measures the greenback against a basket of major peers, was flat in Asia hours at 97.12. The dollar index, which measures greenbacks against a basket major counterparts, was unchanged in Asia hours, at 97.12. Investors waited for the minutes of the Federal Reserve meeting from January, which are due on Wednesday to get a sense of the direction?of interest rates. The euro fell 0.1% to $1.1844, and sterling stabilized at $1.3563 after a 0.5% decline in the previous session. The New Zealand dollar fell 0.6% to $0.6014. The Australian dollar fell 0.2% to $0.7075. The yen firmed by 0.1%, to 153.12 dollars. The Finance Ministry estimated that Japan's annual bond issuance would likely increase by 28% in three years due to rising debt-financing cost. The report stated that Japan would have to issue bonds worth up to 38 trillion dollars ($248,3 billion) in the fiscal year beginning April 2029 in order to cover the gap created by the fact that tax revenues were less than expenditures. This is up from 29,6 trillion dollars in fiscal 2026. Reporting by Scott Murdoch, Editing by Kevin Buckland

-

Prices of oil fall on the back of hopes for a de-escalation of tensions between Iran and the US

The oil prices dropped slightly on Wednesday, as the talks between 'the United States and Iran' progressed. This raised hopes for a deescalation in bilateral tensions. It also reduced risks of disruptions to supply from Middle Eastern oil producers. Brent futures fell?3?cents (0.04%) to $67.39 per barrel at 1:39 GMT. Meanwhile, U.S. West Texas Intermediate crude oil lost 5 cents (0.08%) to trade at $62.28. Both are near their two-week lows. Iran and the U.S. agreed on "guiding principles" for talks on resolving a long-standing nuclear dispute on Tuesday, but this does not mean that a deal will be imminent, according to Iranian Foreign Minister Abbas Araqchi. Analysts remain cautious regarding the possibility of progress being?maintained. Tony Sycamore is an IG'market analyst. In a note to IG clients, he said: "A meaningful breakthrough could ease geopolitical tensions, and possibly boost Iranian oil supplies. However, we are sceptical about whether this?outcome can be achieved within the next few months." In a note sent to clients on Tuesday, the political consultancy Eurasia Group stated that there was a 65% chance of an American strike against Iran before April's end. Reports from Russian media that the output of Tengiz oil field, one the largest in the world, had resumed after being suspended in January, also weighed on the price. Tengiz plans on reaching full capacity by February 23, according to sources. The American Petroleum Institute's weekly report, which is due in the afternoon, and that of the Energy Information Administration (the statistical arm of?U.S. Department of Energy on Thursday. According to analysts polled, U.S. crude stockpiles probably increased last week while distillate and gasohol inventories likely decreased. The 'inventory of crude oil is expected to rise by 2.3 million barrels during the week ending February 13, while gasoline stocks are expected to drop by around 200,000 and distillate stockpiles, including diesel and heating oils, by 1.6 millions barrels. (Reporting from Tokyo by Katya Glubkova; Editing by Edwina gibbs)

-

BlueScope and NAB both jump on a better bid, as Australian shares rise.

Australian shares rose on Wednesday, boosted by a record high for National Australia Bank, after the lender reported?strong numbers in its first quarter, and BlueScope Steel, which jumped at an 'improved takeover offer. As of 0121 GMT, the S&P/ASX 200 was up 0.4% to 8,994.3 points. The benchmark index ended Tuesday 0.2% higher. The benchmark S&P/NZX 50 Index in New Zealand rose 1% to 13,164.88 after the Reserve Bank?of?New Zealand kept its interest rates at 2.25%. The central bank stated that it will continue to maintain its?accommodative monetary policy for some time in order to support the economic recovery. National Australia Bank shares surged 5.8% in Sydney to an all-time record high after the lender posted a 16% increase in its first-quarter cash earning, driven by strong performance across both its business and home-lending segments. NAB shares have pushed the financials subindex up by 1%. If the current momentum continues, it could end a three-day loss streak. NAB is the last of "Big Four" lenders to announce their profits this month. All lenders posted higher profits. The sub-index has risen 8% so far this month due to strong earnings and positive market reactions. Shares of BlueScope Steel soared up to 6% after SGH Ltd and U.S. based Steel Dynamics increased their offer for Australia's biggest listed steelmaker, BlueScope Steel. The new price was A$15 billion (10.63 billion dollars). CSL, a biotech company, led the gains with a 1% gain. The firm signed a deal with Eli Lilly to license certain rights for it to develop and market clazakizumab - an IL-6-blocking anti-body - for patients with advanced kidney disease. The mining sub-index, which was bucking the overall positive trend, lost 0.9%. Gold producers were under pressure after the price of bullion fell on the back of reduced demand for safe havens following the ease in geopolitical tensions.

-

BlueScope and NAB both jump on a better bid, as Australian shares rise.

Australian shares rose?on a Wednesday, fueled by a new record high for the National Australia Bank, after it posted?strong numbers in its first quarter, and BlueScope Steel?jumped at an improved takeover bid. As of 2332 GMT, the S&P/ASX 200 was up 0.5% to 9,005 points. The benchmark index ended Tuesday 0.2% higher. National Australia Bank shares surged up to 5.8%, reaching a new high, after the lender reported a 16% increase in cash earnings for its first quarter, driven by?strong performance across both its home and business lending segments. NAB shares have pushed the financials sub-index up by 1%. If the current momentum continues, it could end a three-day loss streak. NAB was the last "Big Four" bank to announce their earnings in this month. All lenders posted higher profits. The sub-index has risen by almost 8% so far in this month due to strong earnings and positive market reactions. BlueScope Steel shares rose as much as 6 percent after SGH Ltd. and Steel Dynamics, a U.S. company, increased their offer to A$15 billion (10.63 billion dollars) for Australia's biggest listed steelmaker. CSL, a biotech company, gained 1.5% in healthcare stocks after signing a licensing agreement with Eli Lilly. The deal granted CSL certain rights to develop and market clazakizumab - an IL-6 blocking antibody for patients suffering from end-stage renal disease. The mining sub-index, which was bucking the overall positive trend, lost 0.7%. Gold producers were under pressure after the price of bullion fell on the back of reduced demand for safe havens following the ease in geopolitical tensions. New Zealand's benchmark S&P/NZX 50 Index?rose 0.7%, to 13,126.57. Investors awaited the Reserve?Bank of?New?Zealand's policy announcement, which is due later that day. The central bank, it is widely believed, will hold rates.

-

California and Connecticut prepare a 'attack' on Trump's repealing of US climate regulations

Attorneys General from California and Connecticut have announced a "multi-state plan of attack" to combat President Donald Trump's decision to repeal the federal climate regulation for'vehicles'. The Environmental Protection Agency rescinded last week the "endangerment findings" which said that greenhouse gas emissions from cars endanger the public's health. Trump called this "the biggest deregulatory measure in the history of the United States." Connecticut Attorney General William Tong stated in an interview that "we're going to take action" and described efforts to determine standing, claims, and other elements of the?suit. "We are putting together the best possible plan of action." The EPA used its 'endangerment findings' to regulate power plants, automakers and oil and gas operations. About half of the U.S.'s greenhouse gas emissions are attributed to transportation and power. Legal experts also say the move could lead a surge of lawsuits referred to as "public nuisance actions", a path that was blocked after a '2011 Supreme Court decision that the regulation of greenhouse gas emission should be left with the EPA and not the courts. California Attorney General Rob Bonta stated in the interview that states are "looking at facts and laws to challenge the initial?action." Bonta, the California Attorney General, said that they would not wait. "We won't be bringing a lawsuit in six months." It is important to consider the temporal 'nexus' of an action. "But getting it right, and making sure that everything is tight, is also important."

-

Apple trims Apple's Apple iPhones after Berkshire Hathaway purchases New York Times

On Tuesday, Berkshire Hathaway announced a new investment into the New York Times. This marks its return to a sector that Warren Buffett abandoned in 2020 after he sold off his conglomerate’s newspaper business. In after-hours trading, shares of the Times increased by 4% to $76,99. Berkshire reported that it held about 5,07 million Times shares valued at $351.7 million by the end of 2025 in a filing to the U.S. Securities and Exchange Commission. Berkshire filed its U.S. listed stock holdings, which made up the majority of equity in the Omaha-based company. Berkshire also said that it sold 4% of Apple's stake, which is still its largest equity at $62 billion. It also said that 77%?of its 10,000,000 shares in the online retailer Amazon.com were sold during the fourth quarter. Buffett's 60 years as Berkshire's CEO came to an end in the quarter. Greg Abel replaced Buffett as CEO on January 1. Buffett is still chairman. Berkshire’s filing doesn’t say if investments were managed by Buffett or Abel, or portfolio manager Ted Weschler. Todd Combs left JPMorgan Chase in December to become another portfolio manager. Berkshire's stock prices rise every time it announces "new stakes", which investors interpret as a sign of Buffett's approval. It is unclear if this will continue under Abel. Berkshire still hasn't named a replacement for Buffett or announced how it plans to divide up its equity investments. BUFFETT - FORMER PAPER CARRIIER, Dubbed THE TIMES a SURVIVOR Buffett delivered papers as a teenager and had long defended this industry. Selling In 2020, Berkshire will sell its newspaper business to Lee Enterprises, including the Omaha World-Herald in Omaha, for $140 millions. Berkshire became Lee's sole lender. Buffett, who is reluctant to sell businesses in their entirety, told Berkshire shareholders that the Times, Wall Street Journal, and possibly the Washington Post were the only publications with "digital models" strong enough to offset the decline of print circulation and advertising revenues. The Post, which is owned by Jeff Bezos of Amazon, has?since faced its own struggles and this month Layoffs Approximately one third of its employees. Berkshire bought and sold other stocks during the fourth quarter. It added to its holdings of Chevron, Chubb, and Aon, and sold some Bank of America and Aon stock. Abel's shareholder letter and the annual report of Berkshire Hathaway may contain more details about Berkshire's investment. Analysts and investors have stated that Berkshire has been cautious with valuations. They've gone a decade and more without making a major acquisition. Berkshire owns a number of other businesses, including the BNSF railway, Geico auto insurance, manufacturing and energy companies, as well as retail brands like Brooks, Dairy Queen and Fruit of the Loom. Reporting by Jonathan Stempel, New York; editing by Will Dunham and David Gregorio

-

FirstEnergy announces a $36 billion investment program after posting higher annual profits

FirstEnergy announced on Tuesday a $36 billion capital investment plan through 2030 after reporting a 4.3% increase in its full-year profits?as a result of higher electricity rates. As?power consumption?increases across the nation, utilities add billions of dollars in capital investment plans for upgrades to electrical grids and related infrastructure. U.S. electric demand is increasing at an unprecedented pace. Utilities are investing more to meet the growing demand from technology companies to?provide power capacity for their data centers to support AI-related tasks. FirstEnergy CEO Brian Tierney stated that the $36 billion investment plan includes more than $19 Billion in total transmission investments. The company benefited from the newly implemented Pennsylvania rates as well as stronger distribution sales that helped offset its higher operating costs. Utilities are aiming to pass on higher grid-modernization expenses to their customers through a rate increase, due to the increasing demand for electricity from industries electrifying themselves and data centers expanding. The company anticipates core earnings to grow at a compound annual rate of between 6% and 8%, from 2026 to 2030. The 2025 core earnings per share in?its distribution sector increased by 23 cents compared to 2024. The company confirmed its forecast of $2.62 - $2.82 per share by 2026 when it plans to spend $6?billion. FirstEnergy reported a?profit of $1.02billion, or $1.77 a share, for the year ended December 31 compared to $978m, or $1.70 a share, one year earlier. (Reporting from Katha Kalia in Bengaluru and Sumit Sha; editing by Maju Sam)

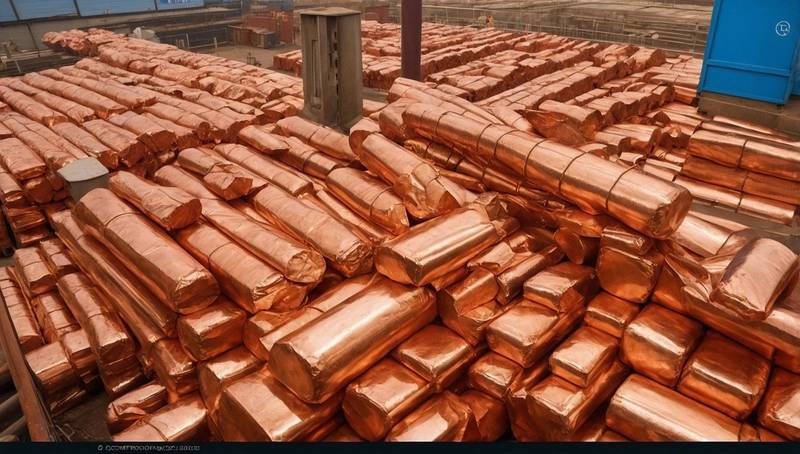

London Copper Prices Fall on Tariff Uncertainty

The copper price in London was slightly lower on Monday as initial excitement over the 90 day tariff truce, between the U.S.A. and China (the top consumer of metal) began to fade.

As of 0707 GMT, the benchmark copper price on London Metal Exchange was down by 0.7% to $9,461 per metric tonne.

The U.S. has agreed to lower tit-fortat tariffs with China and to implement a 90 day pause in actions. Washington also announced that it would reduce the "de minimis tariff" for low-value shipments coming from China to 30 percent.

BigMint, a consultancy, said that analysts project near-term support for prices at $9150/ton. However, spikes could reach $10,000/ton should inventory levels exceed the threshold of 100,000 tons. However, risks remain from U.S. China tariff implementations, smelter profit crises, and negative treatment charges.

ANZ Research reported that Chinese buyers are rushing to import scrap copper from the U.S. after the pause in reciprocal tariffs.

They said that traders are also concerned about trade disruptions due to the U.S. - China trade war.

Separately the Shanghai Futures Exchange is looking at opening its domestic nickel contract to foreign investors in this year instead of launching a contract on their International Energy Exchange.

Other London metals include aluminium, which fell by 0.7% to $2432 per ton. Zinc was down 0.3%, at $2667.5; lead rose 0.3%, to $1967.5; and nickel, which dropped 1.01%, to $15 405. Tin fell 0.01% to $22,895.

The Shanghai Futures Exchange's (SHFE) most traded copper contract eased by 0.3%, to 77540 yuan per ton ($10,736.94).

SHFE aluminium fell by 0.5%, to 20,075 Yuan per ton. Zinc dropped 0.1%, to 22,435 Yuan. Lead fell by 0.3%, to 16,845 Yuan. Nickel declined 0.8%, to 122 870 Yuan. Tin gained 0.3%, to 264 760 yuan.

(source: Reuters)