Latest News

-

Olympic protesters in Milan denounce the impact of Games on the environment

On the first full day of the Milano Cortina Winter Olympics, thousands of people protested in the streets of Milan on Saturday over rising housing costs and concerns about the environment. The march is being organised by housing rights groups, grassroots unions and community centre activists. It aims to bring attention to what activists describe as an unsustainable city model, marked by rising rents and increasing inequality. The Olympics bring to an end a decade of property boom in Milan following the 2015 World Expo. Locals are squeezed by rising living costs, as an Italian tax plan for wealthy new residents and Brexit attract professionals to the financial capital. Some groups claim that the Olympics were a wasteful use of resources and public money, citing infrastructure projects which they claim have "damaged" the environment in mountainous communities. A banner hung across the street said: "Let’s take back cities, let’s free the mountain." CARDBOARD TREE SYMBOLISES DESTRUCTION Stefano Nutini (71), standing under a Communist Refoundation Party flag, said: "I am here because the?Olympics is unsustainable - economically, socially and environmentally." He said that the Olympic infrastructure had "placed a burden on the mountain towns hosting events during the first widely distributed edition of the Winter Games". The International Olympic Committee, or IOC, points out that Games use existing facilities to make them more sustainable. About 50 people led the procession carrying stylised cardboard trees that they claimed represented the larches that were cut down to build a new track for bobsleigh in Cortina. Another banner read: "Century old trees, survivors of two wars...sacrificed 90 seconds on a bobsleigh course costing 124 millions (euros)" March takes place under tight security Police estimates indicate that more than 5,000 participants took part in the march. The protesters started from the Medaglie d'Oro square and walked for nearly four kilometres (2,5 miles) to end up in Corvetto's south-eastern quarter. Corvetto is a working-class area of Milan. According to an interior ministry count, a rally by the hard left in Turin last weekend turned violent. More than 100 police officers were injured, and more than 30 protesters were arrested. Saturday's demonstration follows a series actions in the lead-up to Games. These included rallies the eve before the opening ceremony that denounced U.S. ICE presence in Italy and what activists described as the economic and social burdens of Olympic project. It is a tight-knit security situation as Milan hosts thousands of athletes, world leaders and visitors, including U.S. vice president JD Vance, for the global sports event. (Reporting and writing by Emilio Parodi; Editing by Keith Weir).

-

As Storm Marta hits Spain, Portugal and the UK, farmers report 'catastrophic damage' to crops

Farmers in Spain warned that torrential rainfall and high winds have flooded fields and caused damage worth millions of Euros to crops. Spain and Portugal are bracing for even more extreme weather. In recent weeks the Iberian Peninsula experienced storms that brought heavy rain, hail, snow, and strong winds, all of which will be present when Storm Marta arrives on Saturday. Nearly 170 roads in Spain have been closed, and the rail service in Portugal has been disrupted. Spanish state 'weather agency AEMET warned Saturday that Storm Marta will bring snow, hazardous coastal conditions and more rain. The orange warning is the second-highest after red. Miguel Angel Perez of the COAG farmers' organisation in Andalusia’s Cadiz province, said to Spanish TVE on Saturday, "It rains without stopping." Under water are crops like broccoli, carrots, and cauliflowers. Inundated thousands of hectares. "We have a true natural disaster." Perez stated that the storm caused damage of millions of Euros to this year's crops and farmers will seek help from government to recover. GROUND TREMBLING AND RIVER RAISING The waterlogging of the past few years has raised concerns about structural changes, including landslides. Residents in several towns of the Serrania de Ronda range in Malaga that were battered by Storm Leonardo earlier this week said the ground had trembled on Saturday for days. Cortes de la Frontera's council said in a social media post posted on Saturday, that the tremors felt by Benaojan and Gaucin in nearby towns were "no threat". The Spanish National Research Council (CSIC), which is a government-funded research organization, has sent specialists to the area to monitor conditions. Due to the sudden rise in water level, several residential areas in Andalusia’s Cordoba Province were evacuated Friday. Maria Jesus?Montero, Spain's Vice Prime Minister, warned that the river would reach its maximum level on either Saturday or Sunday. More than 26,500 emergency workers were deployed in Portugal to deal with the effects of the storms. The heavy rains caused three towns to delay the presidential election scheduled for Sunday until next week.

-

Iran threatens to attack US bases if the US attacks

Iran's foreign minister stated on Saturday that it will attack U.S. bases if they are attacked by U.S. troops who have gathered in the Middle East. He also insisted that this was not an attack against the countries that host them. Foreign Minister Abbas Araqchi appeared on Al Jazeera TV in Qatar a day following the announcement by Washington and Tehran that they would continue their indirect nuclear talks after what both sides called positive discussions held Friday in Oman. Donald Trump, the U.S. president, said that while Araqchi had said that no date has been set yet for the next round of negotiations, they could happen as early as next week. Araqchi stated that both he and Washington believed the next round of?negotiations should take place soon. Trump threatened to strike Iran following a U.S. Naval buildup in the?region, demanding it to renounce its uranium enrichment program, which could lead to nuclear bombs. He also demanded that Iran stop ballistic missile development and support to armed groups throughout the region. Tehran has denied for years 'any intention to weaponise the production of nuclear fuel. Araqchi has refused to expand the discussions, despite both sides indicating their willingness to resume diplomacy in the long-running dispute between Iran and the West over its nuclear program. "Any dialogue must be free of threats and pressure. He said that (Tehran only) discussed its nuclear issue. In June last year, the U.S. carried out a bombing of the?Iranian nucleus facilities. This was part of the final stages in a 12-day Israeli air campaign. Since then, Tehran has said that it has stopped uranium-enrichment activities. The?response? included a missile strike on a U.S. military base in Qatar. Qatar maintains "good relations" with both Washington and Tehran. Araqchi stated that the consequences of a future U.S. assault could be similar. He said that it would be impossible to attack American soil. However, we will target their bases located in the area. "We won't attack our neighbouring countries, but rather the U.S. bases that are there." "There is a huge difference between the two." Iran wants to be recognized for its right to enrich its uranium. It also says that Israel would attack it if it put its missile program on the table. Reporting by Jaidaa Alashry and Enas Taha; editing by Kevin Liffey

-

Olympics protesters rally in Milan to denounce impact of Winter Games

On the first day of the Winter Olympics in Milano Cortina, thousands of people are expected to march on Saturday through Milan as a protest against housing costs and urban affordability. The march is being organised by housing rights groups, grassroots unions and community activists from the social centre. It will highlight what activists are calling an unsustainable city model characterized by rising rents and increasing inequality. After the 2015 World Expo in Milan, the city has experienced a boom in the property market. Locals have been squeezed by rising living costs, as Italy's tax system for new wealthy residents and Brexit attracted professionals to the financial center. Police estimates indicate that more than 3,000 marchers are expected to take part. The walk will start at 3 p.m. (1400 GMT), from the Medaglie d'Oro square, and cover a distance of?nearly 4 kilometres (2 miles) before finishing in Milan's south east quadrant?Corvetto. This historically working-class area is located on the southern edge of Milan. An?rally by the hard left in Turin last weekend turned violent. According to a tally of the interior ministry, more than 100 officers were injured and almost 30 protesters were arrested. Saturday's demonstration follows a series actions in the lead-up to Games. These included rallies the eve of opening ceremony, which denounced U.S. ICE presence in Italy and what activists described as the social & economic burdens of Olympic project. Some groups claim that the Olympics are a waste of money and resources, while housing costs are high and meeting spaces are scarce. The march will take place under tight security, as Milan hosts world leaders and athletes, including U.S. vice president JD Vance, for the global sports event. Politic tensions were evident at the opening ceremony of the San Siro Stadium on Friday evening. Vance was jeered by the crowd when an image appeared on the big screen showing him waving the U.S. Flag. (Reporting and writing by Emilio Parodi; Editing by Keith Weir, Editing by Keith Weir).

-

Union: Stellantis-backed ACC cancels plans for Italian and German gigafactories

In a statement issued on Saturday, the UILM (Italian Metalworkers' Union) said that Stellantis-backed Automotive Cells Company told unions they had dropped?plans for building gigafactories both in Italy and Germany. ACC, a joint venture for battery manufacturing in which Stellantis was the largest shareholder, planned to build three gigafactories across Europe - in France, Germany, and Italy. UILM, however, said that ACC management informed them of the "definitely shelved" projects planned for Termoli in Italy and Kaiserslautern in Germany. In a statement released on?Saturday, ACC stated that projects in Germany and Italy have been in standby status since May '2024. They added that it was unlikely that "prerequisites", to restart the projects, would be met. It stated that "different scenarios" are being considered. Stellantis stated that it closely monitored the situation and that "it remains fully mobilised" in order to assess industrial and social consequences. Stellantis shares fell 25.2% Friday, the biggest drop in a single day on record. The Franco-Italian firm booked charges of approximately 22.2 billion euro ($26.5 billion), as it scaled back its electric-vehicle plans. ACC is owned by Stellantis Mercedes-Benz TotalEnergies and has started production in a factory in France. However, the Italian and German projects have been put on hold due to a lackluster demand for 'electric vehicles. UILM stated that Stellantis previously outlined plans to produce gearboxes and engines at Termoli, but did not provide operational details. UILM stated that "the failure to build the ACC megafactory must 'in fact be offset?by clear and coherent industrial - decisions." Stellantis has said that it remains committed to investing in the production of engines and gearboxes at Termoli. As agreed upon a year earlier, these measures aim to support Made In Italy and secure the future of the plant. Stellantis will offer employment to current ACC employees," the company said. Reporting by Crispian B. Balmer, Giulio P. Piovaccari and Aidi Lewis.

-

Union: Stellantis-backed ACC cancels plans for Italian and German gigafactories

The Stellantis-backed Automotive Cells Company told unions that it had shelved its plans to build Gigafactories in 'both Italy and Germany', according to a statement released by the Italian Metalworkers Union UILM on Saturday. ACC, a?battery-joint venture? in which Stellantis was the largest investor, planned to build three gigafactories across Europe – in France, Germany, and Italy. UILM, however, said that ACC management informed them of the "definitely shelved" projects planned for?Termoli in Italy and Kaiserslautern in Germany. ACC stated in a statement released on Saturday that projects in Germany and 'Italy have been on hold since May 2024. They added that "prerequisites" for restarting them were not expected to be met. It said: "While different scenarios are 'being assessed, we've?begun a constructive dialogue with workers council representatives in Germany and unions in Italy in order to... work on any possible discontinuation" of the Kaiserslautern Termoli and gigafactory project. Stellantis shares fell 25.2% Friday, the biggest drop in a single day on record, after the Franco Italian company booked charges totaling around 22.2 billion euro ($26.5 billion), as it scaled back its electric vehicle?development plans. ACC is owned by Stellantis Mercedes-Benz TotalEnergies and has started production in a factory in France. However, the Italian and German 'projects' have been put on hold due to a lacklustre demand. UILM?said Stellantis previously outlined plans to produce gearboxes at Termoli, but did not provide operational details. UILM stated that "the failure to build the ACC megafactory must be offset by clear, coherent industrial decisions." Crispian Balmer, Giulio Picovaccari and Aidi Lewis contributed to the report.

-

Scoot Henderson and the Blazers aim to sweep Grizzlies in two games

Scoot Henderson sat on the bench for the first 51 games, but was eager to return and play with his Portland Trail Blazers team. Third-year pro is finally healthy after being derailed by a torn hamstring left. He hopes to make a solid contribution to the Trail Blazers' match against the Memphis Grizzlies, which takes place on Saturday in the second of a two-game back-to-back series between the teams. Henderson scored 11 points and had nine assists in just 21 minutes as the Trail Blazers thrashed the Grizzlies by 135-115, ending a six-game loss streak. Henderson was able to quickly reintegrate with his teammates and made crisp passes. The fact that he was on the floor was most important. Henderson explained: "All those times when they were playing and I was not, I just took in the game and what we needed." "I went out and tried to do that." "That was moving, staying connected and play fast." Portland scored its fifth highest total of the season. The Trail Blazers shot 54.4% on the field including 17 of 42 (40.5%) from 3-point range. Henderson stated that it was "just fun to be outside". Henderson, 22 years old, committed five turnovers. The rust was obvious. When he was chosen with the third pick in the NBA Draft 2023, the third-year pro?was touted as the future star of the team. Henderson received a lot of support from his teammates Friday. Toumani Camara scored 15 points while Jerami Grant had 23. Memphis struggled to deal with Donovan Clingan's 13 points and 17 rebounds. Deni Avdija, the All-Star of Portland (back), is questionable for Saturday. He sat out the first game for the eighth consecutive time. Shaedon sharpe (left leg) also sat out of the second half, and may not be able to play in the rematch. Sharpe scored two points in the first half of 14 minutes. Cam Spencer, a bench player who scored 18 points off 7-of-8 shots, and GG Jackson both added 15 points to the Grizzlies' loss. This was the seventh defeat in nine games. Jaren Jackson Jr. is no longer with the Grizzlies after he was traded earlier this week to the Utah Jazz as part of an eight-player trade. Jackson was named NBA Defensive player of the Year for 2022-23. Memphis played well in the early part of the game on Friday and led 36-25 at the end of the first quarter. The Grizzlies, however, allowed 81 total points in the second half of the game as Portland made it a rout. Tuomas Iisalo, Grizzlies' coach, said: "I love a lot of things about the way we began the game. I loved the energy, the enthusiasm and the competitive spirit that our team showed, as well as the way we shared the ball." "I believe there are some positives that we can take from this game and use them on Saturday." Iisalo's club trailed in the second and third quarters by 30 points. Iisalo stated, "We gave them the ball and allowed them to score on transition." "We had some communication errors. ... "They also shot the ball better in the second quarter." Scotty Pippen, Jr. made his Memphis debut after a left big toe operation. He had six assists and 13 points in 22 minutes. Scottie Pippen, his famous father who played for the Trail Blazers from 1999-2000 until 2022-03, was courtside. Ty Jerome was out of the lineup (calf). He returned recently and averaged 22.3 point and 7.0 assist in his first three matches of the season, before being held out Friday. Field Level Media

-

China launches its fourth reusable spacecraft since 2020

China launched a reusable experiment spacecraft into orbit aboard a Long March-2F rocket carrier from the Jiuquan Satellite Launch Center located in 'the 'northwest of the country on Saturday. State news agency Xinhua confirmed this. Xinhua reported that the mission would provide technical support to the peaceful use of space by evaluating reusable spacecraft. However, it did not specify how long the 'craft' will be in orbit. The report does not mention what technologies were used or how high they flew. This is the 'fourth launch of a reusable satellite by the country since 2020. It is believed that the development of reusable satellites will be critical in increasing space flight frequency and decreasing costs per mission. In September 2020, the country will successfully launch its reusable experimental satellite for the first-ever time. It will fly in orbit for 2 days. According to Xinhua, a spacecraft?launched on August 20, 2022, returned to Earth by May 20, 2023, after a?276-day orbit. Meanwhile, a spacecraft launching from Jiuquan in September 2024, successfully returned to the designated landing site, after a 268-day orbit. Reporting by Ellen Zhang and Laurie Chen; Editing By Toby Chopra

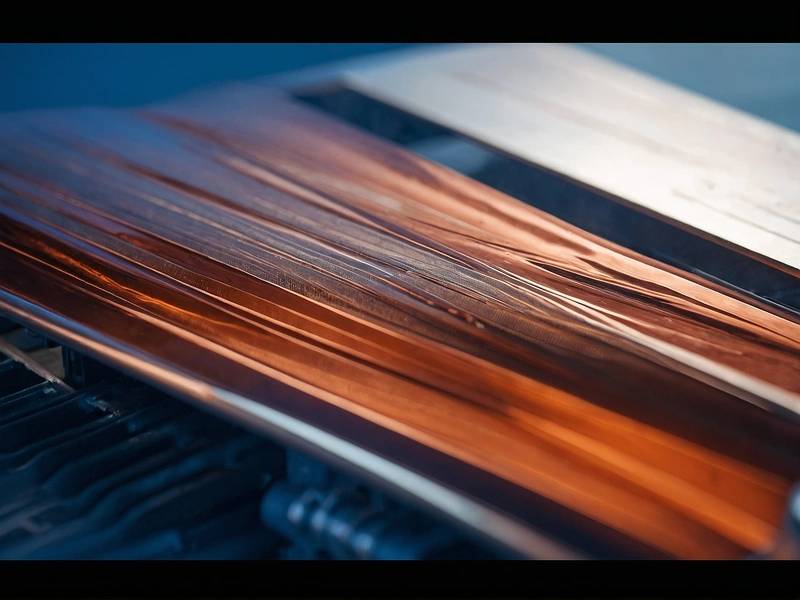

Copper driven higher by technical elements

Copper rates extended gains for a sixth session on Thursday as technical aspects provided momentum and outweighed concern over U.S. Presidentelect Donald Trump's tariff prepare for leading metals customer China.

Three-month copper on the London Metal Exchange ( LME) rose 0.7% to $9,096 a metric ton by 1049 GMT after hitting its highest given that Dec. 16 at $9,099.

The metal used in power and building continues to recuperate from a five-month low of $8,757 touched on Dec. 31. This week brought support on the technical front as it broke above resistance from the 21-day moving average, which now supports at a significant mental level around $9,000.

The market, however, stays concerned about how Trump will handle tariff policy after his return to the White Home on Jan. 20. During the election project Trump pledged to impose tariffs. of 60% on Chinese imports, but there have actually because been clashing. reports on the level of possible tariffs.

CNN on Wednesday reported that Trump is considering. stating a nationwide financial emergency situation to supply legal. validation for a series of universal tariffs on allies and. foes. On Monday the Washington Post stated Trump was. taking a look at more nuanced tariffs, which he later on rejected.

The Chinese yuan, on the other hand, has actually been hovering around a. 16-month low, triggering some Chinese traders to purchase copper to. try to protect themselves from this weakness and uncertainty. about the future, said Ole Hansen, head of commodity method at. Saxo Bank.

The Yangshan copper premium << SMM-CUYP-CN >, which shows. need for copper imported into China, reached its greatest in. more than a year at $73 a lot, versus $43 2 months earlier.

In other metals, LME aluminium increased 1.5% to $2,537 a. load, zinc included 1.4% to $2,864.50, lead gained. 0.2% to $1,942, tin edged up 0.2% to $30,110 and nickel. was consistent at $15,440.

(source: Reuters)