Latest News

-

Rio Tinto receives up to $13.9 Million from Canada for its gallium metal project

Rio Tinto announced on Monday that the Government of Canada had conditionally approved a non-repayable?contribution of up to $13,86 million (?C$18.95) for the'miner's gallium metal research and development project. According to the statement of the firm, this follows the C$7M commitment by the Government of Quebec for December 2024. China's crackdown on critical minerals, such as gallium used in semiconductors and defense applications, has prompted the West to build its own domestic supply of the elements. Jerome Pecresse, Rio Tinto's Aluminum & Lithium Chief Executive, said that removing gallium from the existing refining process will create more value and strengthen the North American gallium supply chain. Gallium is a vital mineral used for everything from high performance radars to smartphones, laptops, electric cars, and laptops. The miner plans to build a pilot plant in Saguenay (Canada) with a capacity?of up?to?4 tonnes of gallium each year. The plant should be operational by 2027. Rio?Tinto has said that a switch to a large-scale commercial plant could increase its?annual?production of primary?gallium up to 40 tonnes. This would represent about 5% global output.

-

Goldman Sachs: The length of the Strait of Hormuz interruption will determine how much aluminium prices rise.

Goldman Sachs stated Monday that the greatest risks for 'aluminium' stem from possible disruptions in export routes and raw material access through the Strait of Hormuz. They noted that the price impact should be minimal if the shipping disruptions last only a short time. The benchmark aluminium price on the London Metal Exchange has risen to its highest level in over a month after the U.S.-Israeli?strikes against Iran. Around 150 ships have been stranded in the Strait of Hormuz - the main shipping artery connecting Asia to Europe - after the commander for the Iranian Revolutionary Guards said on state television that any?ship attempting to transit the strait will be?set on fire. The majority of the Middle East's aluminium is exported to Europe and the United States. Goldman stated in a note on Monday that the market was already trading above fair value. However, prices could continue to rise "substantially", if disruptions continue for at least a month. Goldman Sachs estimates that a month's?full loss of production from the region will reduce?first quarter 2026?global aluminum inventory from 51 to 48 days. In combination with an increase in energy prices, this could temporarily justify a price of $3,600, or about $400 more than spot, to maintain trend margins compared to inventory. The bank stated that its base case is for LME Aluminium to average $3,150 during the first half this year. It also noted that European Aluminium premiums are expected to rise substantially. Ashitha Shivaprasad reports from Bengaluru.

-

US diesel futures hit a 2-year high due to Middle East supply disruptions

U.S. Diesel?Futures surged above $3 per gallon for the first since November 2023 on Monday, as 'Iran responded to U.S. & Israeli attacks on the country with strikes on regional?production?centers & disrupting shipping through the Strait of Hormuz. Analysts and traders say that diesel prices are most vulnerable to the conflict in the Middle East, because this region is the largest supplier of fuel. Also, inventories were depleted after a harsh winter when demand for power and heating was high. The distillate fuel oil is the critical issue. Energy economist Philip Verleger told clients that these stocks were below the normal range. U.S. Diesel?futures closed nearly 12% higher than U.S. Crude and Gasoline futures on Monday. Both settled more than 6% higher and almost 4% higher respectively. Government data shows that the U.S. distillate fuel oil stock, which includes diesel and heating oil was at 120.4 million barrels on February 20. This is more than 5% less than the average of the past five years. Prices test TRUMP's support The rising domestic fuel prices will be a major test for President Donald Trump’s decision to attack Iran, just months before the midterm elections scheduled for November. Voters are likely to have a primary concern about the rising costs. On Monday, gasoline prices at the pump surpassed $3 per gallon for first time since November. Diesel prices are on the rise, which could have a negative impact on U.S. manufacturing and farmers' budgets as planting season begins. Alex Hodes is the energy director for Oasis, a Kansas-based fuel provider. He said that farmers would be the ones to suffer from any increase in diesel prices. He said that fuel is the least expensive of all major expenses for farmers, but also one of the most scrutinized. Verleger stated that the U.S. Diesel prices are also more vulnerable to extreme price changes than they were in the past due to the explosion of data centers across the country. These centers are willing to pay more for diesel fuel to generate electricity than other companies. Verleger stated that the prices at the New York Harbor Spot Market could "jump" from $2.70 to $4 per gallon in the next four week as data centers across the mid-Atlantic begin hoarding fuel. Ritterbusch and Associates stated in a report that refiners are likely to switch their production schedules so as to favor diesel products over other products. This could help 'limit some of these price increases. Ritterbusch stated that the sharp rise in prices will also slow down industrial and freight demand. (Reporting and editing by Niall Williams in New York, with Shariq Khan reporting from New York)

-

Lula's term will see Brazil mobilize more than $50 billion in sustainable investment

Former international affairs secretary Tatiana Rosito said that the Brazilian government plans to mobilize over?250 billion Reais ($48.4 Billion) in sustainable investment during President Luiz Inacio Lula's four-year current term. 2026 will be centered on consolidating initiatives currently underway. Rosito said that Brazil had assembled a wide range of financial instruments to be showcased at its G20, BRICS, and COP30 leadership. She added that the priority is to deliver results and attract capital, rather than creating new tools. Rosito says that Brazil's recent push for policy has helped it regain its status as a global player. Peers now see Latin America's largest economy moving from rhetoric to action. The key efforts include the creation of national ecological transformation guidelines and issuing sovereign sustainable bonds abroad. EcoInvest, which uses public funds to attract private investment into green projects, was also launched. Rosito also pointed to the Brazil Investment Platform for Climate and Ecological Transformation, which lists sustainable projects that are seeking funding. Brazil, after unveiling the platform under its G20 presidency in 2024, helped create a hub for similar initiatives during its COP presidency of last year. This was to encourage cooperation among Global South countries on climate and sustainable finance. Rosito stated that more than 15 countries, including Colombia Nigeria and South Africa have announced plans to create their own platforms. She described Brazil's sustainable finance push as "an innovative system that was built from scratch, which is enabling tangible investments and supporting emerging strategic sectors." Rosito said that the topic of sustainable development has been "almost erased" in some parts of the international forum circuit. This includes the G20, which is under the U.S. Presidency this year. He argued Brazil and its partners must continue to advocate for the importance of the issue. Mathias Alencastro will succeed her at the Finance Ministry, according to a report on Friday. He was previously an advisor to Finance Minister Fernando Haddad.

-

Mining minister: Investor interest in Greenland has increased following Trump's threats

Since the emergence of a?U.S. President Donald Trump has repeatedly threatened to annex Greenland, according to a senior Greenlandic government official. Naaja H. Nathielsen, Greenland’s Minister for Business and Mineral Resources, stated that the UK, Canada, and European Union countries have shown the most interest. She said, "On the investor's side, we saw an increase in interest in investing." She said that although Trump expressed an interest in purchasing?Greenland many years ago, it has been "hectic" over the last two months. The Arctic island is a strategically located, mineral-rich autonomous?territory. Trump has 'intensified his rhetoric about gaining control of Greenland in 2025, and even this year. He claimed that Denmark is incapable of protecting Greenland from Chinese and Russian influences. Greenland sent a delegation of more than 20 mining companies to the Prospectors and Developers Association of Canada's mining conference, which is taking place in Toronto until Wednesday. Benjamin Gallezot is France's delegate to the interministerial committee for metals and ores. He said that France would be willing to take a small equity stake in a mining project in?Greenland in order to help develop it. Nathanielsen stated that Greenland is easing tax and permitting laws to encourage investment. She denied that Greenland "faces a significant risk from China", noting that only "two Chinese companies have mining licenses and that both are inactive." Nathanielsen said, "So?that?is not a high success rate for Chinese investments." She stated that although China is an important exporter for Greenland she does not see the country as a danger.

-

Brazil's Petrobras increases fertilizer production in order to reduce Middle East dependency

Brazilian oil giant Petrobras has increased its nitrogen fertilizer sales in Brazil to help reduce the supply risks as tensions in Middle East threaten the delivery of a key source for the country's imports. Petrobras said that its Bahia and Sergipe units, which resumed operations recently, had reached 90% capacity. The factories are able to supply 12% of Brazil’s urea needs. Urea is one of the most common fertilizers used around the globe to grow crops such as corn, wheat and rice. It's also commonly used for sugarcane,?coffee, sugarcane, and sugarcane. Brazil is increasing its urea production, but it is still heavily dependent on the Middle East. Brazil imported 7.7 million tonnes of urea last year. About?35% came from the Middle East. Tomas Pernias, StoneX analyst of market intelligence, said that the increase in urea in Brazil could help reduce the uncertainty in the market for nitrogen fertilizer due to our dependence on imports. The U.S.-Israeli air attacks against Iran this weekend have already pushed up prices, which is bad news for Brazilian farmers. According to trade data, Iran accounted for about 2% (or urea) of Brazil's supply in the past year. Oman, Qatar and Saudi Arabia are also major regional suppliers of urea to Brazil. Jeferson Souza, an analyst at Agrinvest Commodities, said that the price of urea had been a problem for corn growers even before the conflict. In a social media post, he stated that the outlook was more difficult than it was when the conflict in Ukraine started in?2022, because corn prices are higher and domestic credit is more abundant. Petrobras has stated that it will supply 20% of Brazil's total urea needs when production resumes at its Parana facility. When the Mato Grosso plant is operational by 2029, this could reach 35% of Brazil's urea demand. (Reporting and additional reporting by Ana Mano, writing by Ana Mano, editing by David Gaffen.)

-

US gasoline crosses the $3-per-gallon mark as a test of Trump's Iran War

Analysts say that the average U.S. gasoline price surpassed $3 per gallon on Monday for the first time since November as the conflict in the Middle East intensified. This is a major test of public support for President Donald Trump's decision against?Iran. Tehran's response to U.S.-Israeli strikes on oil production in neighboring nations and ships in Strait of Hormuz has disrupted the global supply of oil. Brent crude has risen by more than 5%, to almost $77 a barrel. Fuel prices are also rising in line with feedstock costs. As Trump and the Republicans prepare for the November midterm elections, higher prices at gas stations are a serious risk. Many Americans struggle to keep up with the rising cost of daily goods. A /Ipsos survey found that nearly half of the respondents said they were less likely to back Trump's Iran campaign if gas and oil prices rose in the U.S. Mark Malek is chief investment officer of Siebert Financial. He said that gasoline prices have a psychological impact. They are the inflation numbers that consumers see daily. Analysts predict that every increase in crude oil price of $10 per barrel will result in a 25-cent increase at the pump. Malek warned that refinery problems could cause fuel prices to rise even more. According to a OPIS database, the average retail gasoline price reached $3 per gallon on Sunday. Tom Kloza said that due to the current crisis they could reach $3.25 a gallon this week. GasBuddy data shows that U.S. gas prices rose for four straight weeks prior to the attack on Iran. Refiners were transitioning to summer-grade motor gasoline, which is required by environmental regulations but costs more to produce. GasBuddy analyst Patrick De Haan said that the conflict would exacerbate?the?increases. De Haan stated that "in the coming week, gasoline prices will likely face increased upward pressure due to seasonal trends continuing and as markets navigate through this changing geopolitical environment."

-

REalloys, a rare earths company, receives Pentagon funding

REalloys, a rare earths company, has received a U.S. Department of Defense Contract worth up to $1.7 Million to fund the design of a metal processing facility used to?make magnets and electronic components for weapons. The Ohio-based firm received the contract from Defense Logistics Agency. It aims to process 300 metric tonnes?per annum of heavy rare earths, samarium, and gadolinium to metal form. This would make the company one of the largest U.S. suppliers of these metals. Rare earths are first converted into metals before they can be used in?magnets. China has placed export restrictions on rare earths, critical minerals and other minerals. The DLA, who buys goods for the U.S. Military, has given REalloy a first vote of confidence with the contract. It is divided into two phases and will last 24 months. REalloys will have to create engineering'schematics' for a modular facility. This is after merging with Blackboxstocks last week. The company has also developed a 'rare earths mine' in Saskatchewan, and it has an agreement to process the minerals with the Saskatchewan Research Council. The President Donald Trump has ordered the Department of Defense to change its name to the Department of War. This will require the action of Congress.

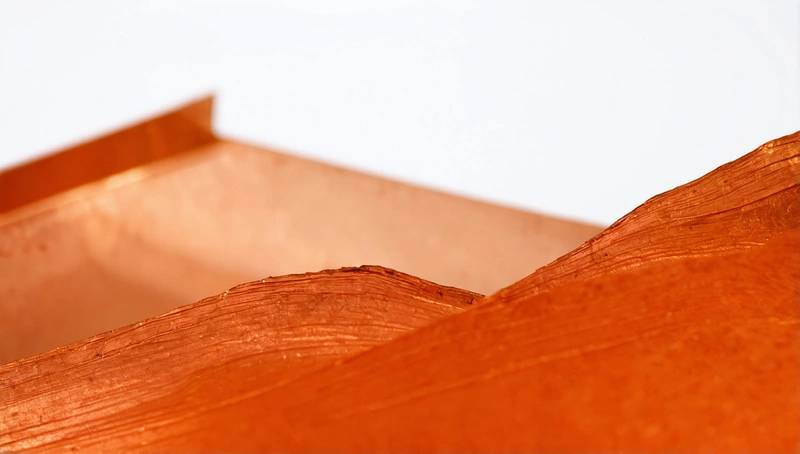

Copper prices fall from multi-month highs on profit-taking

The copper price fell on Tuesday, from its multi-month highs. Profit-taking by traders overshadowed the support of cemented bets that a U.S. interest rate cut would occur and trade talks between China and the United States could progress.

The Shanghai Futures Exchange's most traded copper contract, which had been trading at 81,530 yuan per metric tonne, lost some of its earlier gains and ended the daytime trade up 0.06%. The contract had reached its highest level since March 28, at 81.530 yuan, earlier in the day.

The benchmark three-month copper price on the London Metal Exchange fell 0.61% by 839 GMT to $10,124.5 per ton. On Monday, the contract reached a 15-month high of $10,192.5.

The traders are trying to cash out their profits in advance of the Fed's final rate decision.

Two other traders claim that the rapid rise in prices has been met with resistance by downstream consumers. This has led to a limited increase for them.

A Chinese copper smelter who requested anonymity said that downstream buying had slowed down after prices rose over 80,000 Yuan.

U.S. officials and Chinese officials came to a framework agreement Monday on the short-video app TikTok. This sparked hopes of a close trade deal, which lifted sentiments and limited price drops.

Analysts at Everbright Future noted that the prices were also supported by increased bets on a rate reduction by the U.S. Federal Reserve.

Analysts at Benchmark Minerals Intelligence wrote in a report that rate cuts increase copper prices by combining a weaker US dollar with the expectation of higher demand.

Nickel, among other SHFE metals rose 0.36%. Aluminium fell 0.33%. Tin dropped 0.42%. Zinc lost 0.22%. Lead fell 0.38%.

Aluminium was largely unchanged, while nickel, lead, and zinc all declined. Tin, however, rose 0.23%.

Click here to see the latest news in metals.

(source: Reuters)