Latest News

-

Trump and Netanyahu agreed that the US should pressure Iran to reduce oil sales to China.

Axios, citing U.S. officials who were briefed about the issue, reported that President Donald 'Trump' and Israeli Prime Minister Benjamin Netanyahu agreed at a White House meeting on Wednesday to work towards reducing Iran’s oil exports. Axios quoted a senior U.S. government official as saying, "We agreed that we would go full force and exert maximum pressure on Iran, such as regarding Iranian oil sales to China." China's Foreign Ministry did not respond immediately to a request for comment on Sunday, which was the first day of the Lunar New Year holiday. China is responsible for over 80% of Iran’s oil exports. Iran's oil revenues would be affected if this trade were to decrease. U.S. diplomats and Iranians held nuclear talks last week through Omani mediators in an effort to revive diplomacy. This was after the U.S. President positioned a 'naval flotilla' in the region as the American military prepared for possible sustained, weeks-long operations against Iran. Reporting by Lisa Baertlein, Los Angeles; Additional reporting by Che pan and Ryan Woo, Beijing; Editing and Sergio Non by Diane Craft and Sergio Non

-

New Zealand prepares for heavy rain and severe gales following floods that killed one person

New Zealand's forecaster warned Sunday of intensifying heavy rains and severe 'gales' for the country's North Island. This comes a day after flooding that was linked to the death of a single person led to power outages and road collapses, as well as home evacuations. The weather forecaster stated that "a significant low deepens today east of the North Island, bringing severe gales and heavy rain to the eastern, middle, and southern North Island." On its website, the weather service said that the worst of the storm was expected to arrive late Sunday. This would be followed by a gradual easing on Monday. Heavy rains began 'bashing large areas of the country Friday and causing the flooding. The authorities declared a state-of-emergency on Sunday for the Otorohanga District, a hard hit agricultural region with about 10,000 residents, located 180 km south of Auckland, the nation's largest city. On Facebook, the 'Otorohanga district council said that teams of geotechnical engineers "spent last night assessing slips" and checking the structural stability of roads in the area. Powerco reported on its website that 2,452 homes remained without electricity on the North Island. Authorities reported that a man died Saturday in his car, apparently drowned by floodwaters. They also said that 80 people had been evacuated to an emergency center. Images shared on social media showed vast semirural neighborhoods submerged, and sections of road that had collapsed where floodwaters receded. Reporting by Sam McKeith, Sydney Editing Rod Nickel

-

Judge rules that Exxon Mobil may sue the California Attorney General for defamation regarding recycling

The federal judge rejected the California Attorney General Rob Bonta’s request to dismiss Exxon Mobil’s lawsuit accusing Bonta of defamation for criticizing Exxon Mobil’s?advanced? plastics recycling initiatives. Bonta claimed that he had immunity from suit because he criticised Exxon while in his official capacity of Attorney General and within the "heartland' of his employment duties. The Beaumont, Texas judge said that whether Bonta criticised Exxon with good faith is a factual question to be decided later. Truncale said he had no jurisdiction to hear the claims made against the Sierra Club, Baykeeper Heal the Bay, and Surfrider Foundation. Bonta's Office did not respond immediately to requests for comment. This campaign of lies aimed at derailing our advanced recycling business has to stop. "We refuse to allow others to attack our reputation and technologies?for financial and political gains," said an Exxon spokesperson in a press release. Exxon is increasingly willing to defend itself against critics who claim that its operations are harmful to the climate or increase greenhouse gas emissions. In January 2025 the company based in the Houston suburb of Spring, Texas sued Bonta, almost four months after California filed a lawsuit accusing Exxon for decades of lying about the limitations on recycling. Exxon manufactures polymers that are used to create single-use plastics. Bonta, a Democrat from California, objected Exxon’s promotion of their advanced recycling technology. This process converts hard-to recycle plastic into fuel. REVIEW SOME CHALLENGING STATEMENTS Exxon alleged that Bonta had made 14 statements in interviews, on-line posts, and other public appearances. Three statements claimed that Exxon’s recycling plan "was not based on truth", that plastic waste "piled up" in Houston, despite recycling efforts and that only 5% of U.S.?plastic?waste was recycled, while the remainder polluted the environment, waters, oceans and wildlife. Two of these statements were taken from an interview. In a 46 page decision, Truncale stated that it "wouldn't be unfair" for the statements to be reviewed as possible defamation, because they clearly involved Exxon or were based on Texas-based sources. The judge stated that Bonta's immunity as an official "depends on whether his statements are objectively false." He added that Bonta made a statement in an email with a link to a fundraising campaign, and that "campaigning was not Bonta’s job." Truncale's appointment to the bench was made in 2019 by Republican president Donald Trump. Jonathan Stempel, New York; David Gregorio, Matthew Lewis and Matthew Lewis.

-

Italian PM Meloni offers debt suspension to African states affected by climate shock

Giorgia meloni, the Italian prime minister, said that Italy and their 'African partners' had centered their recent talks on a re-evaluation of the continent's?debt burden. Rome offered countries a chance for them to suspend payments when they are hit by extreme weather events. Meloni, at the end of the second Italy-Africa meeting in Addis Ababa, said: "Today we once again focused on a central issue for?Africa which is debt." "We launched a wide initiative on debt conversion for joint development project. We are adding debt suspension clauses to?this for nations that have been affected by extreme weather events. Meloni will attend the plenary of the 39th meeting of the Assembly of Heads of State and Government of?African Union on Saturday in Addis-Abeba. She didn't give any?details about how the suspension mechanism proposed would work, or which states might?take it up. Italy's foreign policy has placed a high priority on cooperation with African nations, notably through its "Mattei Plan," whose goal, according to Rome, is to create long-term partnerships for energy, agriculture, and infrastructure. (Reporting and editing by Tomaszjanowski)

-

Mali renews Barrick Mining’s Loulo licence for another 10 years

Mali's military leader said in a Friday statement that the government had approved a draft decree renewing Barrick Mining Loulo's gold mining permit for another 10 years. Mali, Africa's largest gold producer, settled a dispute with Barrick in November over profit-sharing, control and ownership of the Loulo-Gounkoto complex of gold mines after two years' negotiations. The dispute was sparked by 2023 mining codes that increased taxes and increased state stakes in projects. Barrick has agreed to withdraw from the World Bank’s dispute tribunal its arbitration case, while Mali said that it would release all employees of the Canadian company, drop all charges and give operational control to the Canadian miner. Barrick conducted a feasibility study as part of the permit renewal. The study identified economically viable reserves that could support six years of open-pit mining or 16 years of underground mines. Gross annual production is estimated to be 420,920oz, according to the statement. Loulo-Gounkoto, located in western Mali, is the 'largest producer in the country and Barrick's most lucrative mine. It will generate almost $900,000,000 in revenue by 2024. (Reporting and writing by Mali Newsroom; Editing and proofreading by David Gregorio).

-

Sources say Valero, a US refiner, will import up to 6 million barrels Venezuelan crude oil in March.

Valero Energy will buy up to 6.5 millions barrels of Venezuelan oil in March for its Gulf Coast refining plants, making it 'the top foreign refiner since the United States captured Nicolas Maduro, in January. Valero is one of the first U.S. oil refiners that resumed imports after the United States signed a landmark $2 billion oil deal with Venezuela's interim government, and started to ease sanctions. If Valero can buy 10 or more cargoes of Venezuelan crude next month, which is equivalent to 210,000 barrels a day, then it will surpass U.S. oil giant Chevron in the United States as the largest refiner. This would be the highest amount of Venezuelan crude oil Valero has processed since the United States sanctioned Venezuela's oil industry in January 2019. Sources told us last month that Chevron, which is the only U.S. oil company producing in Venezuela, will increase its exports to 300,000 barrels per day (bpd) in March from 220,000 in January. Chevron refines about half of its exports in its refineries and sells the remainder to other U.S. refining companies. Valero receives a large share of the Venezuelan oil that Chevron sells to U.S. refining companies. Six sources claim that Chevron will supply Valero most of the oil the refiner plans to import in March. Valero also has negotiated a few?cargoes with trading houses, including Trafigura. Trafigura was the first company authorized by the U.S. Government last month to trade Venezuelan oil alongside Chevron. According to a shipping schedule seen by the. Sources warned that the loading schedules are not finalized, and may still be revised. The sources spoke under condition of anonymity in order to discuss confidential information. Vitol, Trafigura and Trafigura have declined to make any comments. Chevron PDVSA and Chevron did not respond immediately to requests for comments. A spokesperson for Valero referred to remarks made by executive Randy Hawkins following the release of its fourth quarter earnings on January 29, 2019. Hawkins said that Valero is in discussions with Venezuelan oil sellers and expects it to be a large portion of the heavy-crude purchased in February and march. Valero had a long-term agreement with PDVSA to purchase crude oil before U.S. sanctioned. Valero’s total refinery capacity for Venezuelan crude was around 240,000 bpd, before the expansion of its 435,000 bpd Port Arthur, Texas refinery, scheduled to take place in 2023. Hawkins stated that the company expects to now be able to?process a much greater?volume? of Venezuelan crude oil. VENEZUELA IMPORTS RAMP UP The United States Secretary of Energy Chris Wright stated in Caracas that Venezuela's oil exports and production are expected to increase "dramatically" in the next few months. After production cuts were reversed last month, the country's oil output reached 1 million barrels per day (bpd) this month. Exports jumped to 800,000 bpd during January. Wright, NBC News' correspondent on Thursday, said that oil sales in Venezuela under U.S. management have reached $1 billion since Maduro was captured. Another $5 billion will be deposited into a U.S. controlled fund over the next few months. Since January, the United States has issued 'general licenses' authorizing oil exports to Venezuela, fuel supplies, equipment for oil and natural gas production, oilfield extensions, and new investments. According to three sources, Valero is considering purchasing oil directly from PDVSA using the new authorizations. This could allow them to increase their volumes. PDVSA has so far refused to sell to companies that do not have individual U.S. licensing, as there are still questions about what is allowed and what is prohibited, according to sources.

-

Holiday schedule for US economic and other data

Presidents Day, which falls on February 16, will impact the schedule for the release of major economic, energy and commodities reports in Washington for the week beginning February 15. The schedule is below. The times are in GMT/EST. Treasury announcements may be subject to change. Monday, February 16, 2019 Presidents Day. Closed: Federal government offices, Federal Reserve and International?Monetary Fund, stock and Bond markets. Tuesday, February 17, 2019 National Association of Home Builders releases U.S. Housing Market Index, February, 1000/1500 Conference Board releases Employment Trends, January 1000/1500. Rescheduled event from February 9. Treasury Dept. Treasury Dept. The U.S. Department of Agriculture releases weekly U.S. Export Inspections for Grains, Oilseeds, 1110/1600. Note: this week's inspections are delayed from Monday because of the holiday. Treasury Dept. Treasury Dept. Due to the holiday, this sale has been delayed. National Oilseed Processors Association releases U.S. monthly soya crushings, 1120/1700 Treasury Dept. Treasury Dept. Wednesday, February 18, Mortgage Bankers Association releases weekly Mortgage Application Survey, 0700/1200 Redbook releases weekly retail sales index 0855/1355. Note: this is a delayed update from Tuesday. Commerce Dept. Issues Durable Goods Report for December. Housing Starts Report for December. 0830/1330. Note: The Housing Starts report includes initial November estimates Federal Reserve releases Industrial Production for January, 0915/1415 Treasury Dept. Treasury Dept. Treasury Dept. Treasury Dept. Treasury Dept. Treasury Department issues Treasury International Capital Report for December, 16:00/2100 American Petroleum Institute releases weekly national petroleum reports, 1630/2130. Due to the holiday, Tuesday's report has been delayed. Thursday, February 19, 2019 Weekly Jobless Claims Reports by the Labor Dept. Weekly Jobless Claims Reports, 0830/1330 Commerce Dept. releases Advance Economic Indicators for December; International Trade?for December, 0830/1330 Commerce Dept. releases Advance Economic Indicators (AED) for December; International trade?for December 0830/1330 National Association of Realtors releases Pending Home Sales for the Month of January, 1000/1500 Energy Information Administration (EIA), 1030/1530, releases weekly U.S. Underground Natural Gas Stocks. Treasury Dept. Treasury Dept. Treasury Dept. Treasury Dept. Freddie Mac issues weekly U.S. mortgage rates, 1200/1700 EIA releases weekly petroleum stock and output data, 1200/1700. NOTE: time change from Wednesday due to holiday. Treasury Dept. Treasury Dept. Federal Reserve releases weekly balance sheet 1630/2130 Friday, February 20, 2019 Commerce Dept. No time limit is set for the Permit Revisions issued by Commerce Dept. NOTE: Report will include the initial November estimates. Commerce Department issues an advance (first estimate) of U.S. Q4 Gross Domestic Product; issues Personal Income for December, 0830/1330 Commerce?Dept. USDA Releases Weekly Export Sales, 0830/1330. Due to the holiday, export sales are released on Fridays. Commerce Department releases Single-Family Home Sales for December, 1000/1500. Commerce Department releases Single-Family Homes Sales for December, 1000/1500. Report will include November initial estimates Treasury Dept. Treasury Dept. USDA Cattle on Feed monthly, 1500/2000

-

CORRECTED - S&P 500 slightly down as inflation and tech drop

The S&P 500 barely closed higher on Friday. Technology and communications services were down due to lingering fears of AI disruption, but equity markets gained support from optimism that cooling inflation data will support Federal Reserve rate cuts. The CME Group's FedWatch tool showed that U.S. consumer price increases were lower than expected in January. This led traders to increase the probability of a 25-basis point cut in interest rates in June from 48.9% to 52.3%. This is a very good number. This suggests we are still far from the Fed's 2% target, but that inflation is not increasing. Peter Cardillo is the chief market economist of Spartan Capital Securities, New York. Preliminary data shows that the S&P 500 rose 2.32 points or 0.03% to 6,835.08 while the Nasdaq Composite fell 52.04 points or 0.23% to 22,545.11. The Dow Jones Industrial Average increased 47.44 points or 0.10% to 49,499.42. Recent equity markets have retreated from record highs as fears about disruption by artificial intelligence fuelled a'selloff' in sectors from software to insurance and trucking companies. On Friday, the S&P 500 index for software and services closed at 0.9% while the S&P 500 technology sector dropped 0.5%. Friday's inflation data encouraged investor hopes for Fed rate cuts after Wednesday's stronger-than-expected January jobs data sowed doubts. Phil Orlando, the chief market strategist of Federated Hermes, predicted that trading would be more volatile in the coming months. This was in light of AI concerns, looming mid-term elections for the United States in November, and Kevin Warsh, who is expected to replace Fed Chair Jerome Powell in May. Orlando said that the inflation data was better than anticipated and the trend continues to be lower. He said that historically, when a Fed leader transition occurs in a midterm year, it has caused the market to hit "double-digit" air pockets. Megacap tech'stocks' were weak, with Applied Materials and Apple Inc. providing a big boost. The S&P 500 index's 11 major industries were led by the defensive utilities and real estate sectors. The healthcare sector also saw a rise in shares of Dexcom, Moderna and other companies after they reported their fourth quarter earnings. Shares of Applied Materials surged after the company forecast revenue and profits for its second quarter that exceeded Wall Street's expectations. Arista Networks, a provider of networking equipment, also gained in the session as it forecasted annual revenues that were above expectations. White House trade advisor Peter Navarro'said that there was no basis for reports that the 'administration planned to reduce steel and aluminium tariffs. Steel Dynamics and Nucor were among the steelmakers that came under pressure. Alcoa shares fell, as did Century Aluminum. Reporting by Sinead carew in New York; Johann Cherian, Twesha dikshit and Purvi Agarwal in Bengaluru, and editing by Shilpa Majumdar and Pooja desai.

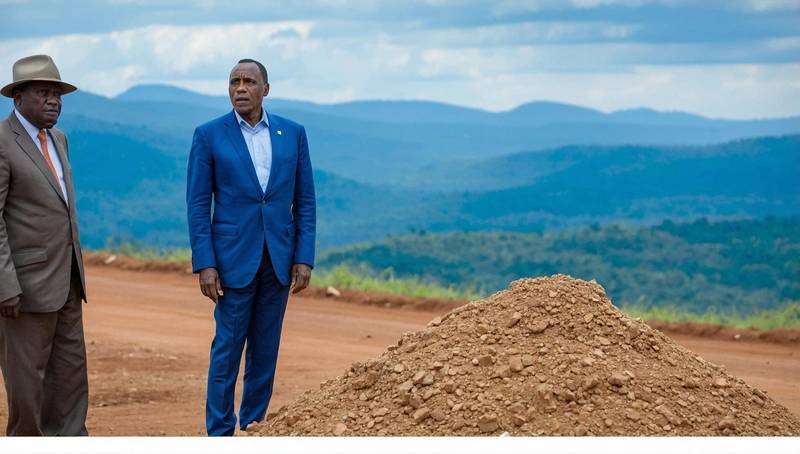

Sources say that US-led peace negotiations could increase Rwandan processing Congo minerals

Three sources said that Congolese minerals, such as tungsten tantalum, and tin which Kinshasa accuses Rwanda of exploiting illegally, could be legitimately exported to Rwanda under the terms of the peace deal being negotiated between the U.S.

Kinshasa sees the pillage of its mineral wealth in eastern Congo as the key driver for the conflict between their forces and the Rwanda-backed M23 rebellions that has intensified ever since January. Kinshasa accuses Kigali smuggling over the border tens or millions of dollars of minerals each month, to be sold by Rwanda.

Massad Boulos told the media earlier this month that Washington wants a peace deal between the two parties to be signed by the end of the summer. This agreement will also include mineral deals aimed at bringing Western investment worth billions of dollars to the region.

He told X last weekend that the U.S. provided a first draft of a contract to both sides. However, its content has not been revealed.

According to two diplomatic sources, and one U.N. official briefed on the matter by U.S. officials, the negotiations may lead to the refinement and marketing of minerals from what is now artisanal mine zones in eastern Congo from Rwanda.

One of the diplomats stated that "their (Washington) point of views is simple: if Rwanda can legitimately profit from Congo's mineral through processing, then it will be less inclined to occupy and plunder their neighbour's minerals."

"Industrialization for Congo would increase revenues, improve the traceability and combat the armed group that lives off the miner's wages."

The foreign ministry did not answer questions posed by a government spokesperson from Congo. It has been long-established that the country wants to shift away from raw exports to local processing.

Unnamed Congolese official said that no cooperation in minerals would be possible without the withdrawal by Rwandan troops, and "their proxy", which is a reference to M23. M23 controls more territory now than ever before in eastern Congo. The official added that Rwanda must also respect "our sovereignty, which includes our minerals." The negotiations may bring Rwanda a large inflow of money that will help clean up a sector of the economy that has been largely illegal. For its part, the U.S. would be able secure deeper access for itself and allies to Congolese minerals assets, which are dominated by China. In a statement released by the U.S. State Department, a spokesperson stated that Congo and Rwanda, in a joint declaration signed last month in Washington, had committed to creating transparent, formalized and licit end to end mineral value chains that linked both countries. investors."

Boulos said last week that U.S. representatives had spoken with "probably 30" U.S. companies about "doing businesses in Rwanda in mining," including downstream processing.

Separately, he said that the U.S. International Development Finance Corporation (an agency tasked with mobilising capital for U.S. national security and foreign policy goals by offering debt financing) would "provide full assistance on these transactions and investment".

Companies that take the plunge in this region are at risk of losing money due to the long history and violence of the area.

HEART CAUSES

Sources said that the minerals projects will not stop a conflict which dates back to the Rwandan genocide of 1994.

A mining agreement will not bring peace. Another diplomat stated that these projects would take three, five, or ten years. There are immediate issues and root causes which need to be addressed.

Congo, the U.N., and the U.S. accuse Rwanda repeatedly of profiting illegally from the exploitation of Congolese minerals resources. Kigali strongly denies these allegations.

Four years ago, an attempt to promote deeper official mining collaboration between Rwanda and Congo failed.

In June 2021 the two sides signed a memorandum relating to the joint exploitation of Congolese Gold by state-owned Sakima, and private Rwandan company Dither.

Kinshasa, however, suspended the agreement in June 2022 citing Rwanda’s alleged support for M23 as well as the rebel group’s capture of Bunagana, the strategic border city.

Rwanda has denied supporting M23, but acknowledged deploying "defensive actions" in eastern Congo to combat Rwandan Hutu militas. Analysts claim that the Democratic Forces for the Liberation of Rwanda (DFLR), the group most often cited, is no longer a serious threat.

According to a diplomatic source, Kinshasa was not seen as a trustworthy negotiating partner by Kigali. They said that the collapse of Sakima's deal was a concern for Rwandan officials.

William Millman is an independent consultant in the tantalum and niobium industries who has visited both mines.

"So, unless you have somebody with a large club, like the United States of America, they won't honour agreements." Reporting by Sonia Rolley and Daphne Psaledakis, both in Paris; Additional reporting from Andrew Mills and Jan Harvey in Doha.

(source: Reuters)