Latest News

-

Sources say that US refiners Phillips 66 and Citgo are looking to purchase crude oil directly from Venezuela.

According to sources who are familiar with these efforts, Phillips 66, Citgo Petroleum, and other U.S. refiners want to purchase heavy crude oil directly from Venezuelan oil giant PDVSA in order to maximize their profits. They do not plan to use trading houses or the U.S. oil giant Chevron. Trafigura Trading and Vitol secured the first U.S. export licenses for Venezuelan oil in January as part of a $2 Billion deal between Caracas & Washington. Chevron holds an authorization to ship and operate in Venezuela since last year. Refiners have purchased cargos from these three companies in the U.S. as well as other countries. The pool of buyers will gradually expand after the U.S. President Donald Trump issued a general licence late last month, which authorized broader oil imports from the OPEC nation. Three sources confirmed that Phillips 66 is a major refiner in the United States and has been seeking internal approval to buy directly from PDVSA. One of the sources said that once the company is ready to go, they plan to charter tankers and load crude oil at PDVSA terminals. Sources spoke anonymously due to commercial sensitivities. A Phillips 66 spokeswoman declined to comment on 'commercial activity, but stated that the refiners Gulf Coast facilities are capable of processing a variety of crude oils and access to heavy oil presents a valuable business opportunity. Last month, the company purchased Venezuelan oil at a price of $9 per barrel less than Brent crude. The White House announced on Friday that the Trump administration is responding in large part to the overwhelming interest of oil and gas companies. Taylor Rogers, a spokeswoman for the president's office, said that "the team works around the clock" to respond to requests from oil companies. CITGO WANT OIL DELIVERED - TO U.S. GULF Citgo Petroleum, a Venezuelan-owned U.S. refining company, is also in discussions to buy crude from Venezuela directly. However, the company wants to have it delivered to U.S. Gulf Coast. This is difficult due to PDVSA’s limited number vessels, according to another source. Citgo intends to use the opportunities under the general licence to purchase crude from Venezuela directly, the company stated in an email statement. It added that it plans to process Venezuelan oil in the coming month at its Gulf Coast refining facilities. Citgo bought from Trafigura in January a cargo of Venezuelan heavy oil for delivery in February. This was its first Venezuelan import since 2019. Three other sources confirmed that Valero, which is the second largest U.S. refiner, and the top buyer of Venezuelan crude oil from Chevron in the United States, will buy directly from PDVSA after assessing the state of Venezuela's loading facilities. The company had previously purchased Venezuelan crude for delivery to the U.S. Gulf Coast from Vitol. Valero will increase its imports of Venezuelan Oil. Up to 6.5 Million barrels of Venezuelan Crude are expected for delivery in March at its Gulf Coast Refineries, making Valero the largest foreign refiner. Chevron is expected to make the bulk of these purchases. Valero and PDVSA didn't immediately respond to requests for comment. Chevron and Vitol have not responded to requests to comment on the impact of refiners buying directly. Trafigura declined a comment. CHALLENGES Ahead Washington is adjusting regulations to do business with Venezuela which remains under sanctions. This could cause refiners to face difficulties in the weeks ahead when trading for April delivery starts. PDVSA told potential buyers that they needed individual licenses from the US or clearance specific to their business. Four sources reported last week that the Treasury's Office of Foreign Assets Control lifted cargoes in its ports. Three sources also said that many U.S. Banks were reluctant to finance Venezuelan oil transactions. Many refiners, in addition to the general license that they intend to use over the next few months, have also submitted individual license requests. Venezuelan crude oil prices have fallen in recent days, as more Venezuelan oil is heading to the U.S. and not China. Sources say that Vitol and Trafigura 'offered Venezuelan Merey Cargoes at $10 Per Barrel Below Brent' in the last few days. This is cheaper than prices as low as $6-$7.50 Per Barrel below Brent from last month. Vitol and Trafigura, according to the U.S. Energy Secretary Chris Wright, have negotiated prices that are around $15 below Brent per barrel for initial Venezuelan crude purchase. This has resulted in $500 million of sales in a single month. Estimates claim that they made up to $4 profit per barrel, after transport and storage costs. Reporting by Nicole Jao, Marianna Pararaga and Arathy Smasekhar from Houston. Editing and editing by Nathan Crooks, Rod Nickel and Rod Nickel.

-

Rare Earths prices rise above the MP Materials price floor

Prices for two rare earths that are crucial to making super-strong magnets used in EVs or defence equipment have risen on the back of a?firm supply and a?firm demand. This is above an unprecedented price floor set by the U.S. As long as the price of MP Materials' neodymium & praseodymium remains above $110 per kilogram, the U.S. Government will not be required to subsidise the company. The price increase to $123 per kg, which is the highest level since July 2022 will also help other rare earth companies that Western governments are hoping will be able reduce their reliance on China, as it is currently the largest producer. China is the dominant supplier of rare earths in the world, with 90% of its refining capacity and 70% of its mined output. The price rally has been driven primarily by the strong downstream magnet demand in China and deliberate supply management. She warned that the price increases are only temporary and that a correction downward is expected by the end March. NdPr oxide: Chinese price The benchmark price, which is 850,000 yuan or $123 per kilogram, has increased from $63 per kilogram on July 9 when MP Materials announced its multi-billion dollar deal with the U.S. Oversupply has pushed down NdPr's prices in recent years. In March of last year, they fell to 345,000 Yuan, their lowest level since November 2020. Mukherjee said that while many operations could sustain production at today's high prices, current market tightness was a?short-term phenomenon and did not reflect the underlying fundamentals of the market. In a 'ground-breaking agreement' with MP, the Pentagon offered MP a price support of $110 per kilogram for its NdPr production to help it better compete against China. According to Adamas, the U.S. government stipulated that the company must stop shipments to China once the material has fed between 7% and 9% of China's NdPr production in the previous three years. Analysts attributed the cutoff in supply to a tightening of the supply in China, due to lower quotas for rare earth mining and melting. However, the Chinese government has not made a public announcement about these quotas.

-

Trump cancels rule that incentivizes EV production to meet fuel efficiency requirements

The Trump administration announced Wednesday that it is rescinding the rule which?incentivized carmakers to make electric vehicles?to meet fuel economy requirements?by overstating energy savings. Environmentalists have long criticised the Energy Department's rules for assigning unreasonably high fuel economy values to electric cars, which then are used to calculate fleetwide medians under Federal Corporate average Fuel Economy rules. After an appeals court ruling in September, the Energy Department announced that it would remove the provision known as fuel content factor and propose further revisions. Fuel Content Factor The DOE said that it concluded the fuel content factor to be "illegal" and issued a rule to remove it immediately from fuel economy calculations. Biden's administration originally proposed eliminating the fuel content from the calculations in 2027. This would have lowered the compliance value for electric vehicles by approximately 70%. The 'Energy Department' decided to phase it out in 2030, under pressure from the automakers. The automakers had noted that the fuel content factor resulted in an estimated fuel economy approximately seven times higher than what would have been calculated using only the Energy Department’s gasoline-equivalent electricity energy content. Fuel Economy Values Environmental groups in the Biden administration argued that the EV mileage calculation should be revised. They argued "that excessively high imputed values for EVs mean that a relatively few EVs can mathematically ensure compliance without meaningful improvement in the average fuel efficiency of automakers fleets." The Trump administration, in December, proposed to slash fuel economy standards set by Biden?in 2020, as part of a push to encourage automakers to offer gasoline-powered vehicles. National Highway Traffic Safety Administration has proposed a significant reduction in fuel economy requirements from model years 2022-2031. The National Highway Traffic Safety Administration proposes a 34.5 mile per gallon?average by 2031. This is down from the current 50.4 miles per galon (21.4 km/liter). Trump signed a law last year that eliminated fuel economy penalties for automakers. The NHTSA confirmed they faced no fines going back to the 2022 model year. Automakers worry that a future administration may reinstate these penalties. Trump has taken a number of steps that disincentivize EV production and purchases, and make it easier for gas-powered vehicles to be produced. (Reporting and editing by David Shepardson)

-

Sources say that Thyssenkrupp may divest its materials trading division by 2026.

Three people with knowledge of the matter have said that Thyssenkrupp is looking at separating, listing or selling its materials trading division this year. They are also considering changing the legal structure to maintain control in the event of a major sale. Thyssenkrupp Materials Services MX, which represents more than a quarter of Thyssenkrupp sales, is another step forward in the overhaul of the group under CEO Miguel Lopez. This comes after a spinoff of its Defence division and as talks continue to be held about selling its Steel unit. MX, with 11.4 billion euros in sales and more than 15000 employees, could be split up via an IPO in the autumn, according to one of those people. The shares of the company, which manufactures everything from automobile parts to chemical plants rose up to 4.2% after the report and were up 2.9% by 1444 GMT. Marc Tuengler, of DSW, the lobby group representing Thyssenkrupp private shareholders said: "This is a logical next step." He said that the move would give a division a more focused and clearer purpose. "Lopez is doing what he promised to do." THYSSENKRUPP MULLS CHANGE OF LEGISLATIVE FORM Thyssenkrupp stated in a press release to? that MX was "well on track" to become capital-market-ready. The company had previously stated that it was looking for a standalone solution to run the business. It was not previously reported when MX might divest and what the legal structure could change to. The people stated that a successful divestment requires the division, which offers both warehousing and trading services for metals and raw materials, to show an improved performance during the second quarter of the fiscal year ending in March. Thyssenkrupp also?examines whether to give MX a legal form of a KGaA. This structure ensures that control remains with the parent, even if the majority of the company is sold. Sources said that the discussions were ongoing and no decisions had been taken, but added that details could change. "We're?confident? that Materials Services can be successfully introduced to the capital markets - despite a difficult environment. The exact timing of any planned transaction will depend on the market conditions, Thyssenkrupp stated in its statement. MX, which sees the U.S. market as its main one, is facing consolidation with its competitors there. Ryerson has?recently merged Olympic Steel, and Worthington Steel plans to purchase Kloeckner & Co. for $2.4 billion. MX, the fourth largest steel service provider in North America, is now ranked behind Reliance Steel, Ryerson/Olympic Steel & Kloeckner. Thyssenkrupp stated that it "sees potential for consolidation on the market. We do not see this as a threat, but rather an opportunity for Materials Services." Thyssenkrupp Material Services' value could be around 2 billion euro based on Worthington’s bid for Kloeckner. This deal values the German company at 8.5x its core profit. ($1 = 0.8442 euros)

-

Andy Home: ROI-Power overrules tariffs, as another US aluminum smelter closes.

The United States has lost another primary metal production plant due to the U.S. import duties. Century Aluminum will cease production at its Hawesville Smelter in 2022 due to the increase in energy prices following Russia's invasion in Ukraine. Once power prices dropped, the company expected to resume operation within a year. Century sold the Kentucky site to TeraWulf, a digital infrastructure company. Aluminum smelters consume a lot of energy. A modern plant can use more than a city of the size of Boston. Big Tech is also willing to pay more for data centers, and the fight for long-term energy supply. HALTING THE SLIDER Last year, U.S. president Donald Trump raised the import tariffs on aluminium to 50% with the stated aim of stopping the decades-long decline in the domestic primary metals capacity. Century's Mount Holly smelter, in South Carolina, has had a limited impact on the immediate future. It will restart 50,000 metric tonnes of annual production capacity. Tariffs were important, but extending the power supply agreement with Santee Cooper (local energy provider) was more?important. By the middle of 2026, the plant will be operating at near-capacity of 220,000 tonnes per year. A 60:40 joint-venture between Emirates Global Aluminium and Century in Oklahoma promises a future of a greenfield smelter that is state-of-the art. Bechtel, a U.S. engineering company, has been selected by the partners to conduct preliminary studies on the proposed plant. It would have an annual capacity of approximately 750,000 tons. Oklahoma is able to produce three times as much energy as it consumes. A power supply agreement for the new plant is still in the works. Even if construction starts on time by the end this year, the first metal production will likely not begin until 2030. Loss of Capacity Flex The permanent 'closure' of Hawesville reduces the idled capacity which could be activated to fill in the gaps before the new Oklahoma Smelter is online. Hawesville is not only the second largest remaining smelter of aluminum in the U.S., with an annual capacity of 252,000 tonnes but it's also a major supplier of high purity aluminium for aerospace and defense applications. Alcoa has a 54,000 ton-per-year production at Warrick in Indiana that is idle, but it does not seem to be in a hurry to restart it. The cost of reactivation is estimated at $100 million, and it would take two years. "At this point, we are unlikely to restart," William Oplinger, Alcoa's President and CEO, told analysts during the company's Q4 results call for 2025 last month. The only remaining smelter is the New Madrid one in Missouri. It was reactivated by 2018 and closed in 2024. Tariffs have reignited hope that the 263,000 ton-per-year facility could be brought back to life, but it would cost a lot and take time, just like with Warrick. Magnitude 7 Metals, the current owner of Magnitude 7, has not indicated its intentions. No Tariff TRUce According to the U.S. Geological Survey, 60% of aluminum consumption in the United States last year was imported. It won't change until the Oklahoma Smelter moves from project status into?actual production. The Trump administration does not seem to be willing to back down on its import tariffs. The White House dismissed media reports that it might lower tariff rates or grant more exemptions, as "baseless speculative". According to an official in the administration, Trump "will not compromise on reviving domestic manufacturing which is crucial to our economic and national security. This includes steel and aluminum production." Some tweaks may be made to the tariffs on aluminium, but a wholesale rollback is unlikely. The price of aluminium in the United States will be high for a few years. S&P Global Platts assesses the Midwest Aluminium Premium, which is traded on CME. This premium captures the tariff impact of the market. The London Metal Exchange Cash Price is $2,290 higher than the premium. This results in a "all-in price" of $5,300 for a ton. Hawesville's inability to survive despite such a?high premium speaks volumes about the fierce competition with Big Tech over competitively priced energy. AI still wins out against aluminium. Andy Home is a journalist. This column is a favorite of yours? Open Interest (ROI), a data-driven, thought-provoking commentary on the markets and finance is available at Open Interest. Follow ROI on LinkedIn, X and X. Listen to the Morning Bid podcast daily on Apple, Spotify or the app. Subscribe to the Morning Bid podcast and hear journalists discussing the latest news in finance and markets seven days a weeks. (Editing by Marguerita choy)

-

Rio Tinto acquires majority control over Canada's Nemaska Lithium

Rio Tinto announced on Wednesday that it had acquired a majority stake in Canada's Nemaska Lithium. This is a step forward for its plan to create an integrated lithium business in Quebec. Anglo-Australian mining company now holds 53.9% of the stake and will take over direct management of the lithium producer, while Quebec government owns 46.1%. Rio Tinto wants to create a "fully integrated" lithium supply chain, starting with the mining of raw ore and ending with chemical processing in Quebec to serve the North American market for electric vehicles. Rio Tinto, the eastern Canadian province and its economic development agency Investissement Quebec have invested in Nemaska 'Lithium' since March - 2025. It was added that the partners would continue to fund this project, which includes the lithium hydroxide facility in Becancour. The first production is expected in 2028. The company announced that Quebec would invest an additional $200 millions?in Nemaska Lithium via share subscriptions. This is on top of the $300 million investment made by Rio Tinto to develop the lithium sector in Quebec in 2026. Through its acquisition of?Arcadium, in March 2025 Rio?Tinto acquired a half interest in Nemaska Lithium. This includes the lithium?hydroxide?plant in Becancour?Quebec and the Whabouchi spodumene?mine located in the Eeyou Istchee region of James Bay, Quebec.

-

Data shows that the share of Russian oil imported by India in January is at its lowest level since late 2022.

According to industry sources, data from January shows that India's oil imports were the lowest since late 2022. Middle Eastern crude supplies rose to their highest level in the same time period. India, which is the third largest oil consumer and importer in the world, has increased its purchases of Russian oil discounted by Western nations following Moscow's invasion of Ukraine in 2022. Volumes have topped 2 million barrels a day in certain months. But Western sanctions on the war, and the pressure to sign a trade agreement with the United States have forced New Delhi to reduce its Russian oil purchases. The data revealed that New Delhi has been forced to reduce its Russian oil purchases. Since November, China has replaced India as Russia's largest buyer of seaborne oil. According to data, India imported about 1.1 millions barrels of Russian crude per day last month. This is the lowest level since November 2022. Moscow's share of overall oil imports has declined to 21.2% - the lowest share since October 2012 The data showed that imports to Russia in January fell by 23.5% compared with December, and about a third from a year ago. Sumit Ritola is a lead research analyst for refining and modeling at Kpler. He said that import levels will likely fall to between 1 million and 1.2 million bpd on average in February, and 800,000 to 1,2 million bpd by March. The timing of some end-month cargoes may cause the February numbers to appear lower, he explained. "February numbers could be slightly lower because they discharge in the next month." INDIA TURNS AWAY FROM RUSSIA AND TOWARDS MIDDLE-EAST Data showed that Indian refiners used alternative grades of oil from the Middle East and South America to make up for lower Russian oil volume. The data revealed that the Middle Eastern oil made up about 55% (or more) of India's total imports for January, while the share of Latin American grades reached a record high of 10%. Ritola stated that "month-to-date February data shows Saudi Arabia regaining their position as India's top supplier, with the imports tracking to a new record high." The data revealed that the lower purchases of 'Russian oil' in India's crude oil imports in January led to a record high of OPEC crude oil. Washington increased import?tariffs for goods coming from India because of its purchases of?Russian crude oil. Under an interim trade deal, the U.S. reduced the tariff to 18%, and removed the 25% punitive tax, claiming that New Delhi agreed to stop purchasing from Moscow. The Trump administration wants India to increase its energy purchases, both from the U.S. as well as Venezuela.

-

Nine skiers are missing and six have been rescued in California after an avalanche

Authorities said that nine skiers are missing after an early morning avalanche occurred in the Sierra Nevada Mountains of?California. However, six other stranded skiers have been rescued. According to a statement on Facebook posted by the Nevada County Sheriff's Office, an avalanche hit the Castle Peak area in Truckee, California about 10 miles from Lake Tahoe at 11:30 am Pacific time Tuesday and buried a group skiers. The injured were treated in a hospital. The sheriff’s office revised an earlier estimate that stated 16 people were in the group. HIGH AVALANCHE RISK The incident will rank as one of the most deadly avalanches in US history if all nine missing skiers perish. Colorado Avalanche Information Center has tallied six U.S. fatalities in avalanches this season. The center reports that on average, 27 people have died each winter from avalanches in the United States during the last decade. On Tuesday, there was a winter storm warning for most of northern California. Heavy snow is forecast at the upper elevations of Sierra Nevada. According to a statement from the Sheriff's Office, the Sierra Avalanche Center posted an alert Tuesday morning before sunrise, warning that there was a "high" avalanche risk in the ski area. Captain Russell Greene of the Nevada County Sheriff's Office said that rescue teams were faced with additional avalanche dangers. Greene told Sacramento-based KCRA-TV that it would be a long, difficult process. "The avalanche risk is still high and they have to take great care when accessing this area," he said. Greene stated that it wasn't a good decision for a ski tour operator to send paying customers into the backcountry in such dangerous conditions. Rescue ski teams from Boreal Mountain Ski Resort, Tahoe Donner’s Alder Creek Adventure Center and Tahoe Donner’s Boreal Mountain Ski Resort were sent to the avalanche area. The survivors took refuge in an improvised shelter made partly from tarpaulin and communicated via radio beacons and text messages with rescuers. Greene refused to say how many ski guides or how many customers are missing. According to a sheriff's report, weather conditions remain hazardous on the Sierra backcountry slopes. Additional avalanche activity is expected Tuesday night and into Wednesday. California - Governor Gavin Newsom has been briefed about the avalanche. State authorities are "coordinating a search-and rescue effort with local emergency teams," his office stated in a post on X. Steve Gorman reported from Los Angeles, and Devika Nair from Bengaluru. Saad Sayeed and Edwina Gibbs edited the story.

Seatrium to Develop FPSO Digital Twins

Seatrium and the Technology Centre for Offshore & Marine, Singapore (TCOMS) have agreed to explore cyber-physical modelling capabilities for predicting environmental loads on FPSOs.

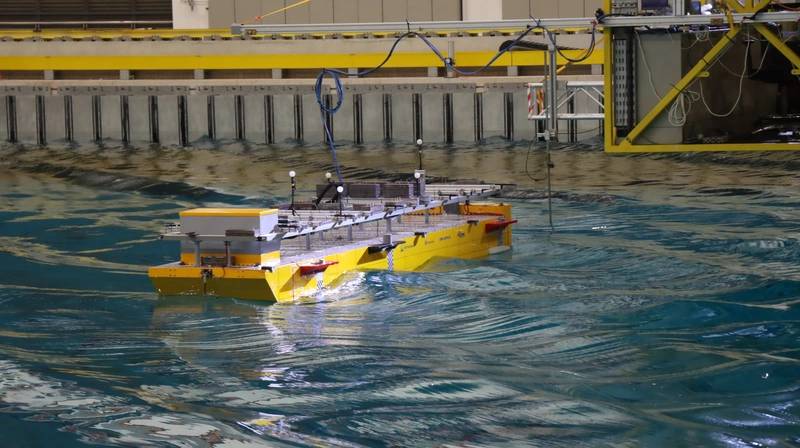

Following the scaled model testing of the latest series of FPSOs that Seatrium is building for Petrobras in TCOMS’ ocean basin facility to validate their global and station-keeping performance, both organizations will now embark on developing digital twins leveraging the extensive data gathered during the model tests.

The P-84 and P-85 FPSOs will be deployed in the Santos Basin, approximately 200 kilometers offshore of Rio de Janeiro in Brazil in coming years.

The FPSOs will incorporate advanced technologies and represent a new generation of offshore production assets with lower GHG emissions.

Engineers and scientists from both companies already partner to co-create, stress test and validate solutions and concepts of future ocean systems and infrastructure. The numerical simulations and physical tests conducted in TCOMS’ ocean basin facility simulate and assess the performance of ocean systems, including those at conceptual stage, in simulated operating and extreme ocean conditions and enhance field performance through technologies such as smart sensing, AI and data analytics. Such modelling and simulation capabilities will facilitate the creation of digital twins.