Latest News

-

Asian shares fall from record highs as bonds and tech-jitters rally

Asian shares fell from record highs Friday, as investors rushed to safe-haven bonds in anticipation of U.S. inflation data. Wall Street's technology-heavy Nasdaq Composite fell?2%? after Cisco Systems reported a quarterly adjusted gross margin that was below expectations due to the rising costs of memory chip. This drove Cisco's shares down by 12%, wiping out $40 billion from its market capitalization. The selling spilled into the tech giants, like Apple. Apple fell 5% on a daily basis in April of last year after President Donald Trump's "Liberation Day tariffs" spooked the markets. Transport companies were also affected by the fear of AI disruption. Chris Weston is the head of research for Pepperstone. He said that "the prevailing tone" in markets was a rotation towards more defensive areas and companies with more predictable, steady and less cyclical earnings. Investors are attempting to price an uncertain future with structural disruption. MSCI's broadest index of Asia-Pacific stocks outside Japan dropped 1.1% on Friday, reducing this week's gains to 3.7%. Japan's Nikkei fell 1.3% but still gained almost 5% this week. The Hang Seng Index in Hong Kong fell 2.1%, while the blue chip index in China dropped 0.9%. The Nasdaq and S&P 500 futures both fell by 0.2% while the EURO STOXX futures rose 0.1%. Financial Times reported on Friday that Trump plans to'scale back tariffs on some steel and aluminum goods, citing sources familiar with the issue. TRADERS AWAIT OUR INFLATION TEST Overnight, the yield on the 10-year benchmark note fell 7 basis points, the biggest drop since October 10th. Early Friday, it was unchanged at 4.1134%. The 30-year bond auction was very successful, and this helped to drive down the longer-term rates. Overnight, 30-year yields fell 8.5 basis points to 4.728%. This is the lowest level since December 3. Fed funds futures rallied as well to reverse the majority of the losses that were caused by the payroll data, which led the markets to reduce the likelihood of a June rate cut. The odds of a rate cut in June are now priced at 70%. A total easing this year is expected to be?60 basis point. The U.S. data on inflation will receive a lot of attention. Forecasts are based on a 0.3% monthly increase in the core measure. This would be sufficient to slow the annual rate to 2.5%, from the previous 2.7%. Jose Torres is a senior economist with Interactive Brokers. He said that even a result in line would represent a significant deceleration compared to December. This could bolster the animal spirits of traders and bring energy back into cyclical trading. The risk-sensitive Australian dollar and New Zealand dollar have taken a step down on the currency markets. The Aussie fell 0.2%, to $0.7071 after losing 0.5% overnight. Meanwhile, the Kiwi eased by 0.1%, at $0.6029. Gold and silver are trying to recover after heavy losses. Gold rose by 1.3% to $4.984 per ounce after losing more than 3% overnight. Silver climbed 2.5% to $75. an ounce. After a steep 3% drop overnight, oil prices continued to decline. AP reported on the transfer of a U.S. Aircraft carrier from the Caribbean into the Middle East, as tensions between the United States and Iran continue to escalate. Brent crude futures dropped 0.2% to $77.37 per barrel. U.S. West Texas Intermediate crude fell 0.3% to $62.66 a barrel.

-

MORNING BID EUROPE - No longer the Apple in their eye

Stella Qiu gives us a look at what the future holds for European and global markets. The tech selloff is back with a vengeance. Cisco was the cause of this latest slump, as its margins were squeezed due to the rising?costs for memory chips. This frightened investors who had been expecting booming profits. AI is causing a lot of concern about the future of jobs. Overnight, trucking and logistics companies suffered a sharp drop in stock prices. This was not long after the software sector plummeted as Anthropic released Claude Cowork to fuel job concerns. Apple was not spared. Apple, the iPhone maker, lost 5% of its market value and astonished investors with a $200 billion drop. It was their worst day since President Donald Trump’s "Liberation Day" tariffs in April last year. Retail investors could take advantage of this dip, as stocks are still near record highs. Maybe the machines are really coming after us. Microsoft AI chief Mustafa Suleyman said to the FT that he expected most white-collar 'tasks' to be fully automated. Most Asian markets are in the red. MSCI's regional market index is down 0.8% but still has a 3.9% gain for the week. Japan's Nikkei fell 0.9% but still gained 5.3% in the past week. In the midst of risk-off, defensive stocks were able to find buyers. Treasuries also benefited from bids for safe-haven assets. Gold and silver tried to recover after heavy losses, while oil was heading for a second consecutive week of losses. The U.S. data on inflation is due later today. Forecasts call for a 0.3% monthly increase in the core measure of the January data. This is enough to slow the annual rate to 2.5%, from the previous?2.7%. Wall Street may need a number that is even higher or better to recover and reach new highs. However, a hot report could cause traders to abandon bets on a June rate cut, sending yields skyrocketing. The following are key developments that may influence the markets on Friday. CPI data in the U.S. for January -- Euro Zone GDP flash estimate for Q4

-

Iron ore prices fall as traders reduce their positions before the China holiday

Iron ore futures fell on Friday, as traders 'closed out their positions before a Lunar New Year holiday that will last a full week in China. During this time demand is expected to drop significantly. As of 0322 GMT, the most-traded?iron ore May contract on China's Dalian Commodity Exchange was down 1.5% at 752.5 Yuan ($108.97). This week, the contract has fallen by 1.63%. The benchmark March ore traded on the Singapore Exchange fell 1.24% to $98.35 per ton. This week, the contract has lost 0.7%. If the current momentum continues, it is on course for a fifth weekly?decline. Data compiled by LSEG shows that the trading volume for Dalian Iron Ore has increased. This is likely because traders are closing out positions before the Chinese New Year weeklong holiday, from February 16-23. The number of shipments from Australia has declined since?tropical Cyclone Mitchell formed last week off the coast in the resource-rich Pilbara area. Atilla Winnel, Navigate Commodities' managing director, says that hot metal production has been declining at 229 thermally monitored furnaces as operators continue to idle or warm bank their furnaces in preparation for the holiday. The demand for feedstock will?decrease significantly during the holiday. During this time, most steel mills are shutting down or performing planned maintenance. News:?Brazil’s trade body decided to impose antidumping measures on coated flat?steel? and cold-rolled flat steel? from China. Brazilian miner Vale reported a net loss in the fourth quarter of $3.8 billion. Vale's?iron ore costs decreased by 2% year-on year, making it?the company's second consecutive year with cost reductions. Coking coal and coke, two other steelmaking ingredients, moved in opposite directions. The majority of steel benchmarks at the Shanghai Futures Exchange rose. Hot-rolled coils firmed up 0.06%, while stainless steel hardened by 0.12%. Meanwhile, wire rod dropped 2.24%.

-

Qatar increases April al-Shaheen term oil price to five-month-high, sources say

QatarEnergy, the state-owned oil company, has increased the 'term price' for al-Shaheen crude loading in April, to the highest level in the last five months, according to?several sources?. This is due in part because the Middle Eastern market was supported by a better demand in India. According to the sources, the April term price of al-Shaheen oil was set at 87c per barrel according to Dubai's quotes. This is a significant jump from the March term price, which was 33c less per barrel. It was also the highest price since November. Spot premiums on Middle?Eastern oil have risen this month due to improved?demand in India. Refiners there are now avoiding Russian crude oil, which will help New Delhi reach a deal with Washington. QatarEnergy has sold six al-Shaheen shipments, three of which were to the Indian refiner Reliance. Sources said that the rest of the cargoes were sold to Shell and?Totsa (the trading arm for TotalEnergies). Loading of the cargoes, which each contain about 500,000 barrels is scheduled for April 1-2. Qatar also awarded a Qatar Marine crude shipment?to Japanese refiner Eneos for a "small premium". The people said that it also awarded a Qatar Land shipment to Reliance for a?premium of about $1.10 per barrel. Typically, companies do not comment about their commercial agreements.

-

But will this last?

Copper smelters were rewarded in China when Ukrainian drones struck Russia's Astrakhan Gas Processing Plant last September. Astrakhan is a major producer sulphur. This sulphuric?acid is used in mining, fertilisers and more and more in the battery supply chain. When Russia stopped sulphur imports, acid prices nearly doubled by the end of the year. The economics of copper melting in China are being rewritten by the surge. Smelters are turning to sulphuric acids as a source of profit, as earnings from their core businesses decline. Analysts warn this leaves them vulnerable to a volatile, unrelated market where prices will be expected to fall even though traditional processing fees are continuing to decline. The sulphuric Acid price jump of about 500% in two and a quarter years gave China's copper?smelters an estimated $1.5 billion last year, as traditional smelting charges collapsed. According to the half-year results of Yunnan Copper published in August, sulphuric acids sales accounted for 790 million Yuan ($114) or about a quarter gross profit. "Acid should be a secondary product, not a main source of profit. This creates risk," Peter Harrison, an CRU analyst said. NEW ?MONEY, OLD MONEY Treatment and refining fees (TC/RCs) are the most common way smelters make money. The influx of new smelters, especially in China's top producer, has increased the bidding on concentrate that was previously scarce due to mine closures and disruptions. Benchmark TC/RCs dropped below zero in December of 2024, and reached a new low of minus $49. The sulphuric-acid prices have, on the other hand, moved in the opposite direction. According to National Bureau of Statistics, they reached about 1,045 Yuan ($145), per?metric tons in early January. This compares to 464 Yuan a year ago. Analysts say that the tight global sulphur supplies due to disruptions such as the Ukrainian strikes, and uneven smelter production, have constrained availability of feedstocks used to produce sulphuric acids. Zambia banned exports of acid in September to protect its mining industry. As around 40% of China’s sulphur is imported, the higher prices on the global market quickly filtered through to the domestic acid markets. The demand is expanding beyond fertiliser. According to CRU, consumption linked to Indonesia’s nickel mining sector grew to less than a tenth the total sulphur requirement. Harrison explained that while these segments are still small in comparison to fertilisers and other industrial applications, they have helped tighten a market which for many years had limited demand. Craig Lang of CRU says that sulphuric acids now account for 64% or more of smelters revenue from 'byproducts' and non-TC/RC, compared to 27% in the past. Yunnan Copper, which announced record profits from the sulphuric acid it produces, warned investors of volatility. Daye Nonferrous, a competitor of Yunnan Copper, also warned that prices were uncertain around the time. Anna Xu is an analyst at Wood Mackenzie. She said that smelters were hesitant to accept negative TC/RCs because they feared the market would quickly turn around. In theory, she said, smelters could accept negative TCs on long-term agreements if sulphuric acids prices were above 1,000 yuan a tonne. The smelters insist on zero because the price of sulphuric and precious metals is uncertain. Chilean miner Antofagasta In December, some Chinese smelters agreed to TC/RCs worth $0 during negotiations. Harrison predicts a decline of 10-30% in prices over the next few months. Beijing's November decision to limit exports and to keep more acid in the country for the fertiliser sector, as well as new projects beginning are cited. Lang explained that any material decline in price, combined with negative TC/RCs, creates a logical argument for capacity reductions. If acid prices fall significantly, smelters may reduce production by reducing maintenance or lowering utilisation.

-

Weekly oil drop due to Iran risk receding and oversupply concerns

The oil price was little changed Friday, after falling the previous session. It is set to fall for a second consecutive week, as concerns about an Iranian conflict, which could affect supply, have receded. Brent crude oil futures were up 3 cents or 0.04% at $67.55 per barrel at 0205 GMT, after dropping 2.7% the previous session. U.S. West Texas Intermediate crude oil rose by 1 cent, or 0.02% to $62.85, after falling 2.8%. Brent prices will drop by 0.8% while WTI is expected to fall by 1.1%. Prices rose earlier in the week as investors worried that the U.S. might attack Iran, a major Middle Eastern oil producer over its nuclear program. However, comments made by U.S. president Donald Trump on Thursday that the U.S. may strike a deal with Iran within the next month pushed prices down. The oil prices have fallen "amid signs that the U.S. wants more time to'reach a nuclear deal with 'Iran. This reduces the near-term risk premium," IG Analyst Tony Sycamore wrote in a recent note. The International Energy Agency projected Thursday in its monthly report, that global oil demand will grow less than expected this year, and the overall supply is set to exceed the demand. Sycamore, of IG, said that the decline on Thursday was exacerbated by data earlier this week showing a massive increase in U.S. crude stocks and growing expectations that an increased?Venezuelan oil supply would soon be available. He said that there is a?expectation of Venezuelan oil supply returning to pre-blockade level in the months to come, which would be a rise from 880,000 barrels / day to?about 1.25 million bpd. A White House official on energy said that the U.S. Treasury would issue additional allowances this week to ease sanctions against Venezuelan energy. Chris Wright, the U.S. Secretary for Energy, said Thursday that oil sales from Venezuela controlled by?the?U.S. Since the January capture of President Nicolas Maduro, the United States has collected over $1 billion in oil sales. Another $5 billion is expected in the coming months. (Reporting and editing by Christian Schmollinger, Lewis Jackson and Sam Li in Beijing)

-

Asian shares fall from record highs as bonds and tech-jitters rally

Asian shares fell from record highs on Friday, as investors sought safe-haven bonds in anticipation of U.S. inflation data. The Nasdaq Composite, a technology-heavy index on Wall Street?slid?2% overnight after Cisco Systems reported a quarterly adjusted gross profit margin that was below expectations due to a surge in the cost of memory chips. This drove Cisco's shares down by 12%, wiping out $40 billion from its market capitalization. The selling spilled into the tech giants, like Apple. Apple fell 5% on a daily basis in April of last year after President Donald Trump’s "Liberation Day tariffs" spooked the markets. Transport companies were also affected by the fear of AI disruption. "The current 'tone in the markets is a shift towards more defensive areas of equity and companies that have steady, less-cyclical, and more predictable earnings," Chris?Weston said, head of Pepperstone research. Investors are clearly looking at AI and AGI developments through a different lens. They're trying to price an uncertain future, one that is more disruptive and structurally uncertain than ever before. MSCI's broadest Asia-Pacific share index outside Japan dropped 0.6% on Friday, reducing this week's gains to 4.1%. Japan's Nikkei fell 0.9% but still gained?5.3% this week. Hong Kong's Hang Seng index fell 1.5%, while Chinese blue chips declined 0.6%. The Nasdaq and S&P 500 futures both rose by 0.1% while the EURO STOXX futures climbed 0.2%. Gold and silver are trying to recover after heavy losses. After a loss of over 3%, gold rose 1% to $4972 per ounce. Silver gained 2% to $76.2 an ounce after a 10% drop overnight. TRADERS AWAIT OUR INFLATION TEST Overnight, the yield on the 10-year benchmark note fell 7 basis points, the biggest drop since October 10. Early Friday, it was unchanged at 4.1154%. The 30-year bond auction was very successful, and this helped to lower the longer-term rates. The 30-year yields fell overnight by 8.5 basis points to 4.728%. This is the lowest level since December 3. Fed funds futures rallied as well to reverse the majority of losses following the payrolls data, which led markets to reduce the likelihood of a rate cut in June. The odds of a move in June are now priced at 70%. A total rate easing of 60 basis points is expected for this year. The U.S. data on inflation will attract a lot of attention. Forecasts focus on a 0.3% monthly increase in the core measure. This is enough for the annual rate to slow from 2.7% to 2.5%. Jose Torres is a senior economic at Interactive Brokers. He said that even a result in line with December's would reflect a significant deceleration. This could boost animal spirits and bring energy back to the cyclical trading. The risk-sensitive Australian dollar and New Zealand dollar?took back a step on the currency markets. The Aussie held steady at $0.7089 after losing 0.5% overnight. Meanwhile, the Kiwi traded at $0.6033. After a sharp drop of 3% overnight, oil prices were unchanged on falling demand. This eased fears about a renewed conflict in the Middle East and increased supply. Brent crude futures rose 0.2%, to $67.65 a barrel. U.S. West Texas Intermediate crude fell 0.2% at $62.95 a barrel.

-

Sources say that the supply of crude oil from Saudi Arabia to China in March will reach a multi-year record.

Saudi Arabia's crude oil exports are expected to reach a multi-year high in March, after the kingdom lowered its official selling price to Asia for the fourth consecutive month. This has also led to an increase in demand. Saudi Aramco, the state oil company, will ship at least 58 million barrels of crude oil to China in march. This is about 1.87 mbpd. A tally from trade sources shows that this amount represents a daily allocation to Chinese refiners. Records show that the allocation volume is up from the two previous months when it was?under 50 million barrels.?It's the highest since October 2022. The tally revealed that PetroChina, Rongsheng Petrochemical, and Sinochem were among the companies who planned to increase Saudi crude lifts in January. Sources claim that Hengli Petrochemical is set to lift zero volume in a third month. Aramco refused to comment on the allocation of crude oil to China in March. The'refining companies didn't respond to requests for comment. The March 'OSP' for Arab Light crude oil was set to parity with Oman/Dubai, down from a premium $0.30 per barrel in February. This is the fourth consecutive month of a cut. Data showed that the March OSP was 'the lowest since December 2020, although the 30-cent price reduction was smaller than anticipated. Reporting by Siyi Liu in Singapore and Florence Tan; editing by Lincoln Feast, Jacqueline Wong

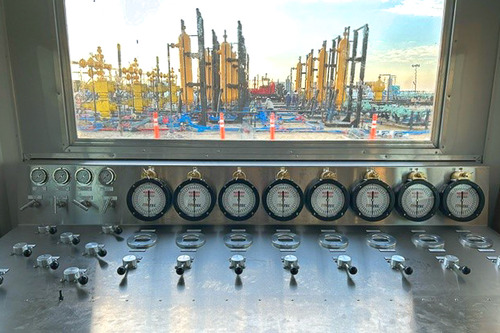

Control System Automation Maximizes Your Operation

Pressure control equipment is the backbone of the Oil and Gas Industry. It is the first and last line of defense in pressure and flow control. Advancements in valves, chokes, blowout preventers (BOPs), relief valves, and other equipment have allowed our industry to become exponentially more efficient in the production of Oil and Gas. If pressure control equipment is the backbone of our industry, then the control and automation systems are the brain. Originally designed to eliminate human presence in hazardous areas, these systems have evolved with technology, expanding their capabilities.

As pressure control equipment has progressed, so have the control systems used to control and monitor its operation. Most of this equipment operates manually, requiring personnel to enter a high-pressure area, “red zone”, and expose themselves to potentially dangerous environments while actuating the equipment. Over time, injuries and accidents have led many operators to require this equipment to be remote-controlled using hydraulic, pneumatic, or electric actuation. This necessity led to the development of remote-control systems to monitor and control these actuators.

CORTEC Hydraulic Choke & Valve Command Center Control Panel in the Field

As recently as 30 years ago, most control systems were analog; they were generally hydraulic power units (HPUs) with minimum monitoring instrumentation. Industry standards, such as API 16C, API 16D, and others, exist that dictate the basic requirements for critical well control systems like choke and kill and BOP systems. These standards are regularly reviewed and constantly evolving, yet they only represent the minimum requirements for controlling and monitoring this equipment.

These minimum requirements are sufficient to perform pressure and flow control operations safely in most instances, but higher levels of functionality are available. Basic remote-controlled systems will open and close chokes and valves as the user directs, and will monitor pressures and positions to control the equipment as if it were being manually controlled. However, the advancements in electronic and hydraulic components have revolutionized the design of control systems. These technological developments have enabled the creation of systems that operate with higher efficiency, offer greater access to information, and empower operators to exercise better control over their equipment, significantly enhancing the overall performance and reliability of control systems across the industry.

CORTEC_CX-HB3.0 Hydra-Balance Dual Choke Setpoint System

Advanced control systems can host a myriad of sensors that display and record information based on user-specific set points, such as pressure, flow rate, and position, which has proven to be very efficient and eliminates human error. By continuously monitoring pressure levels and making rapid adjustments through automated valve and choke control, these systems prevent dangerous situations, helping optimize process performance while minimizing the need for manual intervention and alerting users to issues before they become catastrophic. The data collected by these advanced control systems can be aggregated and analyzed to develop better procedures for operations, resulting in improved efficiency. Nevertheless, control and automation systems are not “one size fits all”; they vary based on an operator’s specific needs. What is being controlled? What is the operation? What information is needed for control, such as temperature, pressure, position, fluid level, flow rate, etc.? What can we automate? What safeguards do we need to put in place? These are some of the questions we ask in the preliminary design stage of a control system.

In most cases, users are often unaware of the potential for automation and are frequently surprised by unique suggestions for automating operations they usually perform manually. Instead of settling for minimal control, CORTEC aims to create control systems that can optimize the performance of your pressure control equipment and enhance your overall operation. We provide a variety of options, including standard API 16C monogrammed drilling choke control systems, resettable relief valve controls, choke command centers, frac relief valve control, auto bleed-off and equalization systems, and automated sand dump control systems, to name a few.

CORTEC CX-EC3. MPD Choke Setpoint_System

CORTEC offers turnkey automated solutions to complement our choke and valve products for drilling and completion operations. These solutions deliver systems with precise control in a simple, manageable package. Our experienced team has designed these control system configurations to accommodate a variety of end-user preferences. Whether you need a single setpoint system or conventional well control, CORTEC has the expertise and capability to deliver custom compact control consoles or larger command centers that meet your specific requirements and result in a substantial reduction in operating costs and increased efficiency.

To learn more about how CORTEC can help you maximize your operation with turnkey automated solutions, visit uscortec.com/products/automation or contact us directly at [email protected] .